Tension is growing towards the all important meeting of the European Central Bank.

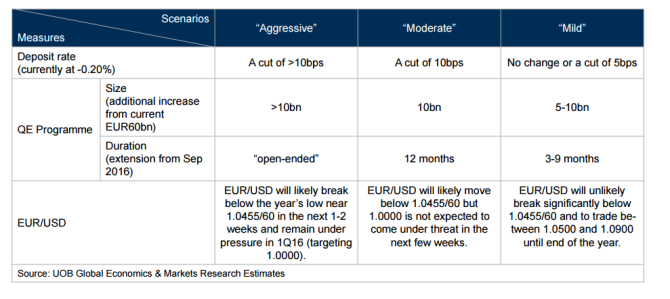

The team at UOB provides a table of scenarios and some explanations to the EUR/USD reactions:

Here is their view, courtesy of eFXnews:

In a note to clients, UOB Group outlines 3 broad scenarios for the ECB meeting next week that are likely and the possible implications for the EUR.

UOB Take: The “Mild” Easing Approach. “Following the October ECB meeting, we highlighted that at the minimum, we are expecting the ECB to announce in December, an extension of the existing bond-buying programme by 3-9 months. A modest (possibly EUR10bn) step-up in the pace above EUR60bn/month is likely. A small rate cut is also a reasonable bet, perhaps by just 5bps in its deposit rate to -0.25%, with corresponding cuts to the Bank’s other main policy rates.

Since then, the market has turned more bearish. But we continue to maintain our view that the ECB is likely go for the “mild” approach. These are a few reasons why:

1. Currently slated to run through September 2016, the ECB’s EUR60bn-a-month QE program was launched only in March this year and has not even been around to mark its first birthday. Several central bank officials have stated that it could be too early to fully judge whether more easing is needed or if the current program is doing the trick. Besides, the ECB would want to save its limited ammunition.

2. The other reason why there could be less pressure to deliver a more aggressive QE immediately is the fall in the EUR since the last ECB meeting. In fact, EUR/USD has been one of the most travelled currency pairs, still suffering from a double blow: the ECB expected to ease, against the Fed who is expected to lift-off.

3. The Fed is also a crucial factor. The challenge here is that the ECB is scheduled to meet before the Fed does in December, so it will not know for sure where Fed policy is headed when it sets its own. And doubts still remain over whether the Fed will even pull the trigger this year at all. But interestingly, if both central banks push ahead, it would be the first time in more than 20 years that US rates went the opposite direction from European rates, and the first since the Euro’s introduction. In May 1994, five years before the Euro was launched, the Fed raised rates whilst Germany’s Bundesbank (the rate-setter then) cut.

“The ECB announces its interest rate decision on Thursday, 3 December, at 8.45pm Singapore time, followed by Draghi’s news conference at 9.30pm. On the EUR/USD, we have seen a sizeable selloff in the pair, which from the highs of 1.1495 in October, has come tumbling down to current levels of around 1.0600,” UOB clarifies.

Even if the ECB goes with the “mild” scenario we are expecting, our expectations of EUR/USD trading between 1.0500 and 1.0900 until the end of the year, is lower than our current year-end projection of 1.1200. We are thus inclined to revise lower our EUR/USD forecasts but will finalize our revisions only after the ECB’s meeting,” UOB concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.