The US dollar was recently seen struggling, and as a result prices of the precious metals managed to rise and recover ground. However, GOLD is currently trading in a range and it looks like it is setting up for more gains moving ahead. There were a couple of important releases lined up recently in the US, which were mostly better than expected, but failed to push GOLD and SILVER lower. Today, the US durable goods orders data will be published. Let us see how the outcome shapes and affects the US dollar. The chance of break higher in GOLD is looming ahead of the release.

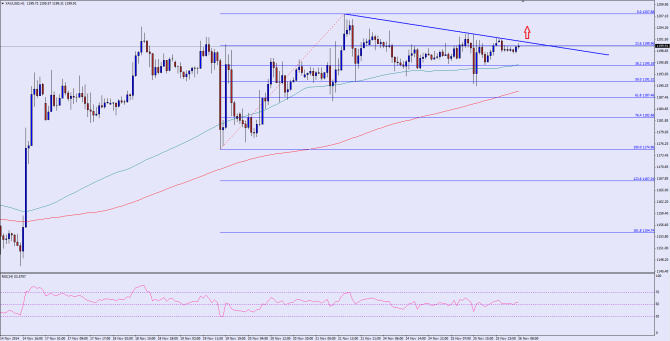

There is a critical bearish trend line formed on the hourly chart of GOLD, which is currently protecting the upside. However, there are a lot of bullish signs developed on the hourly chart, as GOLD is trading above the 100 and 200 hourly moving averages. Moreover, it recently bounced a couple of times from the 50% fib retracement level of the last leg from the $1174 low to $1207 high. Let us see whether GOLD buyers can manage to break the highlighted trend line or not. A break above the same might take the prices towards the $1210 level, followed by the $1230 level. Any further gains might be limited in the near term.

On the downside, the most important support is around the 100 MA, followed by the 200 MA which is sitting around the 50% fib retracement level.

Overall, one might consider buying with a break above the trend line as long as GOLD is trading above the 100 MA.

————————————-

Posted By Simon Ji of IKOFX