On December 4th, at 03:30 GMT, the RBA will make its rate decision and the markets expect a cut from 3.25% to 3.0%. The Australian dollar was very weak during the last few days compared to other risk-on currencies, so we need to keep in mind that a rate cut may already be calculated in market price.

Therefore, despite a possible cut, AUD could spike higher and cause »buy the rumor sell the fact « reaction. Anyhow I have a bullish GBPAUD count and bullish AUDJPY pairs here which is obviously a different story for AUD.

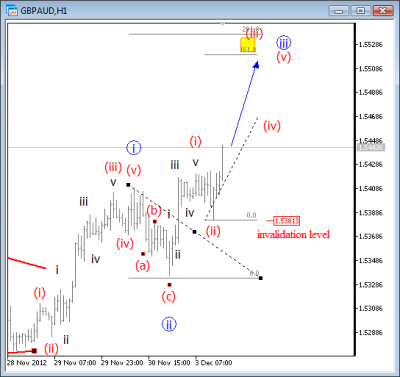

If AUD will fall after the announcement then GBPAUD will probably rise sharply, maybe even in wave three of three towards 1.5530. In such case we would be interested to buy fourth wave pull-back.

GBPAUD-bearish count for AUD

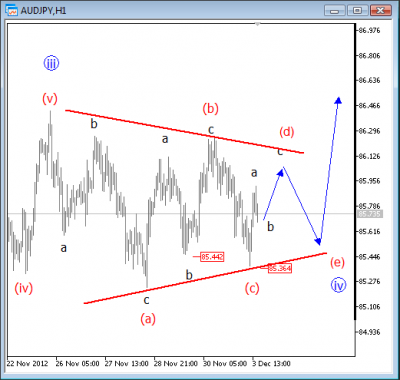

If AUD will gain significantly after the report, then AUDJPY should be on the radar, because GBPAUD will probably become invalid count. In such a case our focus will be a break higher, out of a fourth wave triangle.

AUDJPY-bullish count for AUD