Commodity-export economies run a seemingly unavoidable cycle. When the rate of production is less than the rate of consumption prices accelerate. When the demand is great enough, it creates something of a ‘horse race’ among producers. Increased capacity can capture more profit quickly so production ‘ramps-up’. Demand eventually reaches a peak; production overshoots demand creating over supply, prices drop, excess capacity is shut down. Thus the boom becomes bust.

Guest post by Mike Scrive of Accendo Markets

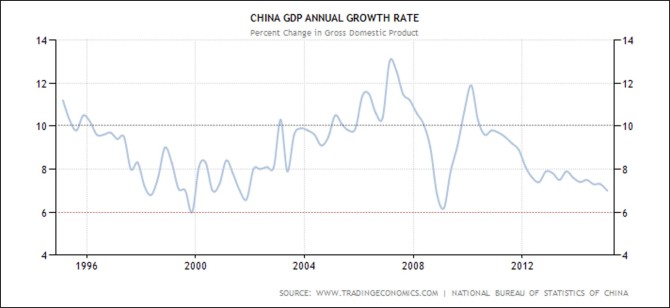

It seems that the latest boom is approaching the end of its cycle. Every large scale commodity export economy is currently feeling the pinch. However, the world seems to be split: in the Western hemisphere, the largest commodity consumer, the United States is hardly growing, but seems to have bottomed out. In the eastern hemisphere it’s still uncertain whether China’s economy has reached a sustainable growth rate.

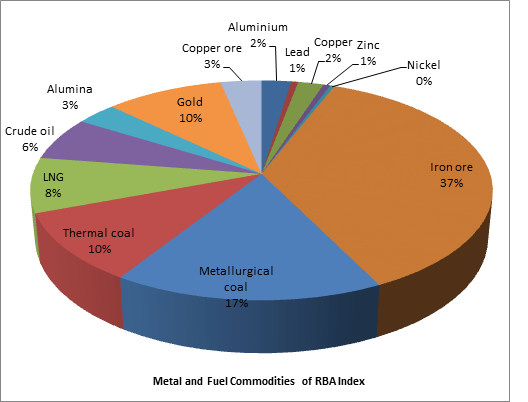

There are three factors at work on USD/AUD: The Reserve Bank of Australia, the US Federal Reserve Bank, and the Chinese economy. It should be noted that over 29% of Australian exports are destined for China, over 80% of which are industrial or fuel commodities. Only about 3.5% are destined for the US and of those exports almost 25% are agricultural products; just over 14% are industrial or fuel commodities. The point of the matter being is that China’s economy factors far more heavily on the Australian economy than does the US economy. Hence the RBA must react to the effects of the slowing Chinese economy; hence US Fed actions and RBA actions are relatively independent. Hence the Aussie and Greenback react pretty much independently. (As opposed to, for example, the relationship between US Dollar and Canadian dollar).

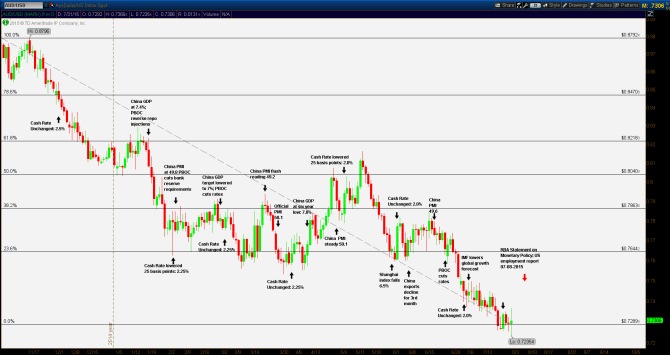

In a nine month chart AUD/USD reached its high in mid-November of 2014 at 0.8796 AUD per USD. At the time the RBA had maintained the overnight deposit rate at 2.50% and would do so for the next six weeks. The US Fed, on the other hand, was not getting data points indicating a definitive positive change in economic growth and maintained its 0.25% target Fed Funds rate. On 20 January China’s GDP was reported to be 7.4%, and the PBOC injected liquidity via a reverse repo pass just before the Lunar New Year holiday. Further, lower interest rates and a strengthening US Dollar were creating sustained capital outflows from China’s banking system.

By February, PRC economic data continued to indicate weakness: PMI below 50, CPI came in below expectations and factory prices declined. The PBOC responded by increasing liquidity in every which way except by reducing interest rates further . The RBA also concerned by the effect on the Australian economy and reduced the cash rate by 25 basis points to 2.25% at the February meeting. At this point, the Aussie had declined nearly 11.5% vs the Greenback from the nine month high, to 0.7792 per.

On 2 March, two days before the expected annualized GDP growth was lowered to 7% at the National People’s Congress, the PBOC surprised markets by lowering borrowing rates across the board . The following day, the RBA decided to maintain the cash rate at 2.25%. At the next Fed meeting 18 March, the board decided to hold the overnight rate at 0.25%. On 24 March, the HSBC/PMI reading again indicated declining factory orders. USD/AUD responded by breaking below 0.7644 support. At the 7 April policy meeting, the RBA maintained the cash rate at 2.25%.

In April, China’s factory data turned positive and AUD/USD rallied on an improvement in PMI data, slightly above 50. The Fed Funds rate remained unchanged at the 18 April meeting. However, China’s first quarter GDP came in at a 6 year low as well as having disappointing retail sales, industrial output and cap-ex spending. It should also be noted that from the beginning of the year to this point commodity prices continued to steadily decline. Further, the Shanghai composite, up over 100% year to date, plunged 6.5% in one session ; capital outflows continued and exports declined for the third consecutive month.

The RBA reacted at the 5 May policy meeting, lowering by 25 basis points to 2.00%; the Aussie continued its rally through resistance at 0.8040 to 0.8112 before it reversed, declining to nine month trend line at 0.7603. This happened to coincide with the RBA policy meeting at which the cash rate remained at 2.00%. Before the next RBA meeting commodity prices continued to correct and the PBOC cut rates and stepped in to support a collapsed equities market. At the 8 July meeting the RBA keep the cash rate at 2%.

From the July mini-rally to the meeting, AUD/USD lost nearly 10%. AUD/USD closed the month of July at its nine month low at 0.72354, 17.75% below the November 2014 nine month high of 0.8796. The next RBA policy meeting is scheduled for the end of the first week of August; the next Fed meeting is in September.

The above narrative, from the beginning of the year to this point, clearly indicates an unraveling of the world’s second largest economy and Australia’s best industrial commodities customer.

What might be expected? Lower than forecast US Q2 GDP and a much lower than expected wage growth indicator, decreased the likelihood of a September Fed Funds rate increase. An important employment report is scheduled for release on 7 August. As noted above, without the boom-time demand from the PRC, the domestic Aussie economy will need further stimulus. The RBA has carefully spaced out cash rate cuts, buying time and having enough cash rate slack to work with. The expectations then would likely be that the Fed will hold rates steady at least until December, while the RBA must keep its domestic economy stable.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”