The RBA not only left the interest rate unchanged but also left the language about the exchange value mostly unchanged. While Glenn Stevens and his colleagues probably prefer a lower value for the A$, the interest rate tool might not be the preferred tool, as elevated housing prices in Sydney and Melbourne become an issue.

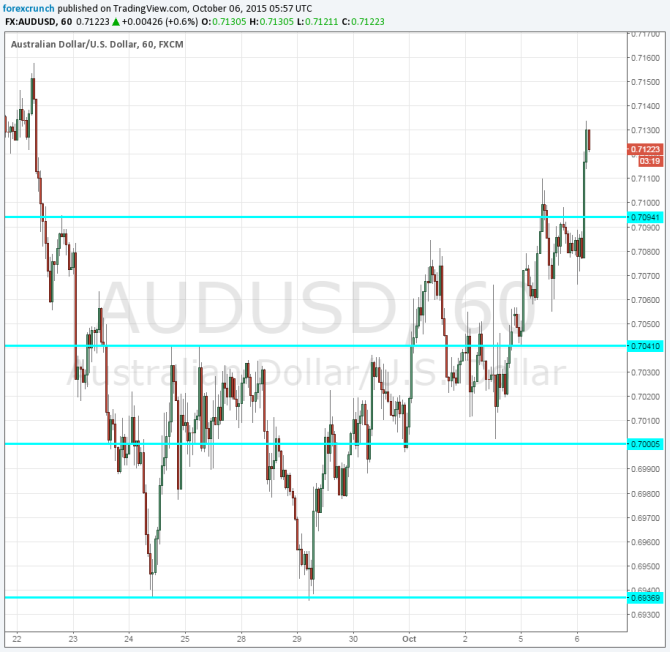

AUD/USD broke above 0.71, a line that capped it for quite some time.

The Australian dollar is adjusting to the lower commodity prices says the RBA. They are satisfied, but not necessarily looking for further falls for AUD. In addition, the economy is operating with spare capacity and that inflation will remain consistent with the target over the medium term.

Here is a paragraph from the statement:

In other asset markets, prices for commercial property have been supported by lower long-term interest rates, while equity prices have moved lower and been more volatile recently, in parallel with developments in global markets. The Australian dollar is adjusting to the significant declines in key commodity prices.

This is the fifth consecutive month of unchanged interest rates in the land down under. The current rate is the historic low of 2%.

Earlier’s Australia’s trade balance came out at a disappointing large deficit of 3 billion instead of 2.4 billion expected. That kept the pair away from 0.71 and at 0.7065. But once the news came out, the pair rallied to 0.7134.

More: Buy AUD/USD Tactically – Morgan Stanley Chart of the Week