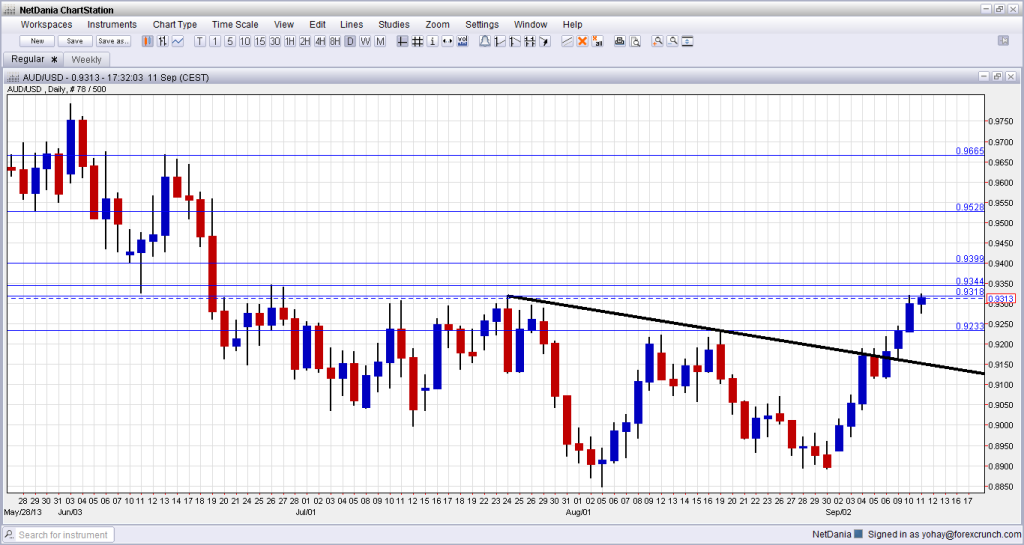

The Australian dollar continues its recovery and reached a high of 0.9323, just above the 0.9318 high of July. The last time it saw these highs was back in late June, when it marked the 0.9344 level as resistance. This line isn’t too far now.

There was no particular trigger for this move. The trigger for the last push was a wave of USD selling across the board. Yet there are quite a few reasons for the Aussie’s rise in the past two weeks.

Let’s look at the chart. The reasons follow:

- A new government: The elections in Australia saw a decisive outcome with Tony Abott replacing Kevin Rudd. The new government is not only a majority one (contrary to the minority government), but also considered more market friendly.

- Signs of Chinese stabilization: after a long round of lower forecasts for Chinese growth, the picture is beginning to change and some banks are even upgrading the forecasts for 2014. In addition, both official and unofficial manufacturing PMIs are now positive. Other data from Australia’s No. 1 trade partner have been positive as well.

- Not so dovish RBA: the Reserve Bank of Australia began the Aussie sell-off back in May and is now underpinning the currency. The recent rate statement was not-so-dovish. Rate cuts aren’t likely anytime soon. This helped stop the sell off and continues supporting the pair.

- Lower tension around Syria: the recent headlines point to a diplomatic solution and Obama has postponed the vote in Congress regarding a strike. This triggered some “risk on” behavior that weakened the US dollar and the yen, and helps the Aussie.

- Front running the employment data?: Australia will release job numbers early on September 12th. A gain of 10K jobs is expected. Are markets beginning to price a better outcome?

See how to trade the Australian job numbers with AUD/USD.

AUD/USD levels

At the time of writing, the pair trades just below the 0.9318 line which was the high of July. 0.9344 looms above: it was the high of June, after the big collapse that month. 0.94 is a round line and also provided support at that time. 0.9530 provided support in May.

Below, 0.9233 works as support after capping the pair twice in August. Ir is followed by support at 0.9115, which was a stepping stone in September.

For more events, charts and analysis, see the AUDUSD forecast.

What do you think?