The Australian dollar seemed to be protected from the rout in commodity currencies after inflation came out stronger than expected, contrary to the figures in New Zealand and Canada. However, after the Australian press raised the chances of a rate cut already on February 4th and together with a stronger USD, the Aussie continued a fast deterioration.

What’s next for AUD/USD? The team at BofA Merrill provide a chart and targets:

Here is their view, courtesy of eFXnews:

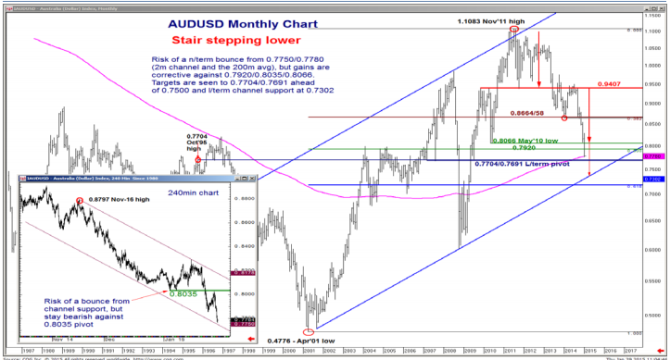

AUD/USD continues its descent, notes Bank of America Merrill Lynch.

“While there is risk of a n/term bounce from 0.7750/0.7780 (2m channel and the 200m avg), gains are corrective against 0.7920/0.8035/0.8066,” BofA argues.

“Targets are seen to 0.7704/0.7691 ahead of 0.7500 and l/term channel support at 0.7302,” BofA projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.