The Australian dollar showed some resilience in the wake of the not-too-dovish FOMC meeting minutes, while other currencies surrendered to the greenback’s strength. Not anymore.

A Chinese data knocked the Aussie down. Is it joining the pack or can it recover?

HSBC and Markit released their preliminary manufacturing PMI for China and it certainly disappointed: the figure fell from 51.7 to 50.3 points, well below 51.5 points expected and too close to the 50 point mark that separates growth from contraction. China is Australia’s No. 1 trading partner and this independent indicator triggers worries about slower growth and thus weaker demand for Australian commodities.

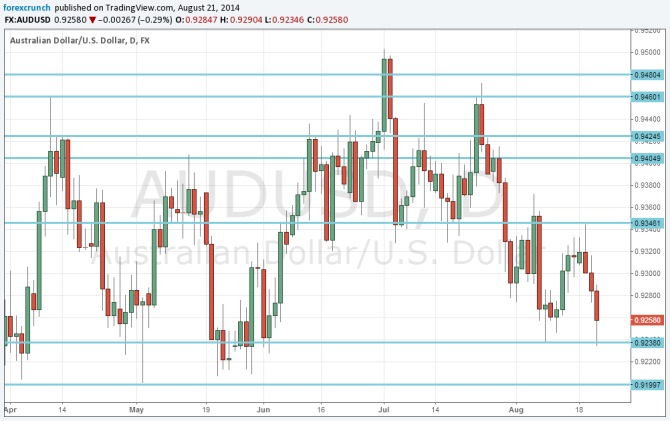

The dip below 0.9250 reflects the lowest levels since June. The round 0.92 level that supported the pair back in May is critical support from here. 0.9140 follows. On the upside, 0.9340 is the recent top of the range.

Here is how it looks on the chart:

For more, see the AUDUSD prediction.