AUD/USD posted modest losses last week, dipping below the 1.04 level. The pair closed the week at 1.0380. This week’s highlight is Employment Change. Here is an outlook of the events and an updated technical analysis for AUD/USD.

The RBA maintained interest rate levels at 3.0%. There was some solid key releases out of Australia, as Building Approvals and Retail Sales were above expectations. However, the Aussie failed to take advantage, as continuing weak US numbers are leading investors to shy away from the risky Aussie in favor of the safe-haven US dollar.

Updates: AIG Construction Index dropped sharply to 39.0 points, as contraction in the construction industry continues. ANZ Job Advertisements declined 1.5%. NAB Business Confidence improved, coming in at 2 points. Westpac Consumer Sentiment will be released on Wednesday. AUD/USD continues to move higher, as the pair was trading at 1.0423. Westpac Consumer Sentiment plunged 5.1%, its worst showing since December 2011. MI Inflation Expectations gained 2.2%, little changed from the March reading. Employment Claims looked awful, posting a decline of 36.1 thousand claims. This was way off the estimate of 06.7 thousand. The Unemployment Rate climbed to 5.6%, up from 5.4%. Despite the weak employment numbers, the Aussie rally continues. AUD/USD was trading at 1.0565.

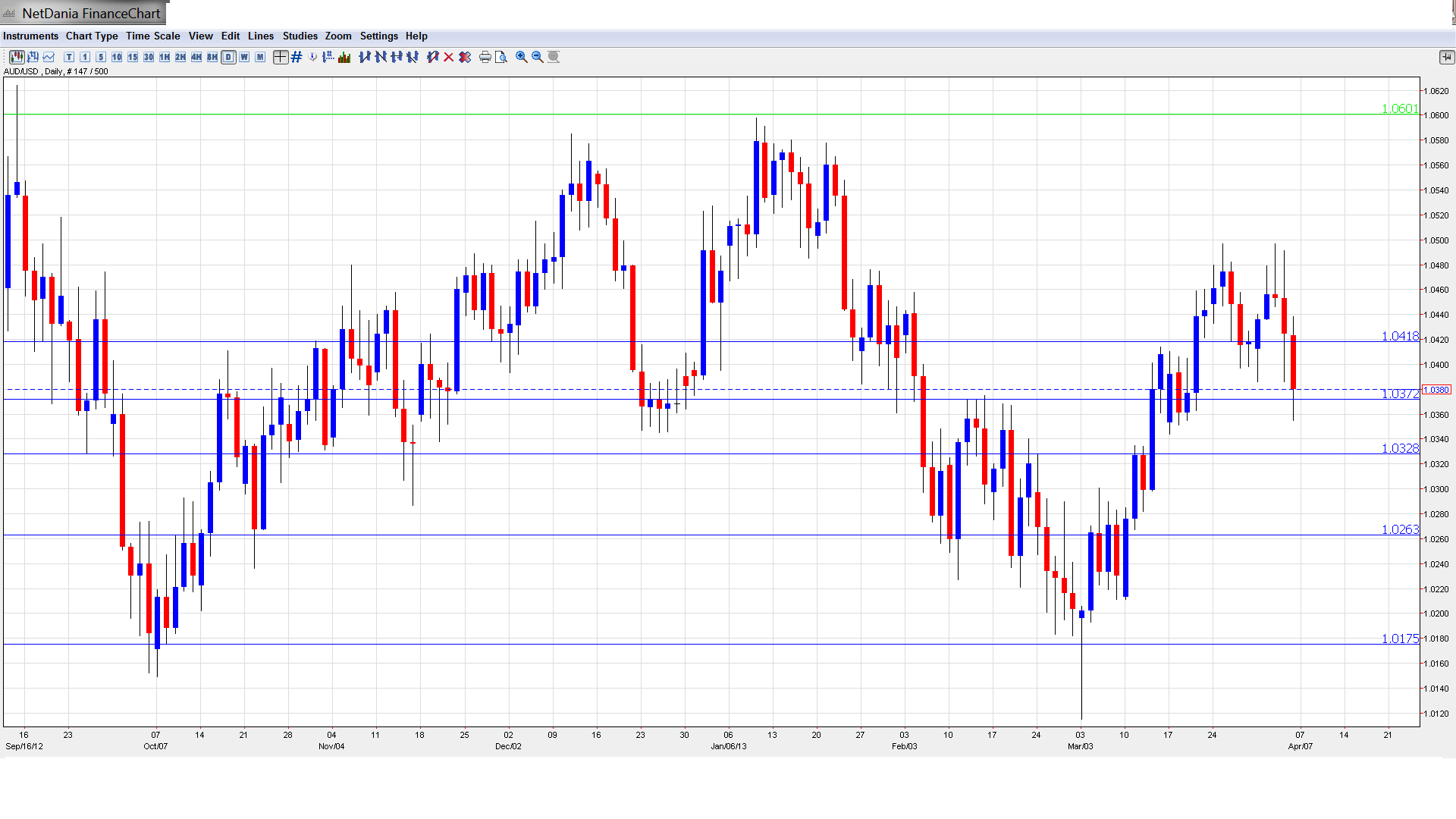

AUD/USD graph with support and resistance lines on it. Click to enlarge:

- AIG Construction Index: Sunday, 23:30. This index has been stuck below the 40-point level for the past year, indicating sustained contraction in the construction sector. However, the March releases showed a sharp rise, with a reading of 45.6 points. Will the index continue to push higher in the April release?

- ANZ Job Advertisements: Monday, 1:30. Job Advertisements helps provide a snapshot of the employment situation in Australia. After a long slump, where the indicator posted consecutive declines, the indicator bounced back in March, posting a 3.0% gain. The markets will be hoping for another strong reading in the upcoming release.

- NAB Business Confidence: Tuesday, 1:30. This diffusion index surveys businesses as to their level of confidence in the economy. A reading above zero indicates that economic conditions are improving. The index started 2013 with two consecutive readings of 3 points, but then dropped to 1 point in the March reading. Will the index bounce higher in the April release?

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer confidence is a leading indicator of consumer spending, as an increase in confidence leads to consumers spending more, which is critical for economic growth. The indicator has been erratic in recent releases, making accurate predictions a tricky task. Consumer Sentiment posted a 2.0% gain in the previous reading, and the markets will be looking for the indicator to meet or beat this figure.

- MI Inflation Expectations: Thursday, 1:00. Analysts use this indicator to help predict actual inflation figures. The indicator has been rising steadily this year, rising from 1.8% in December 2012 to 2.3% in March. Will we see another gain in the upcoming release?

- Employment Change: Thursday, 1:30. Employment Change is the highlight of the week, and is one of the most important economic indicators. In March, the indicator went through the roof, posting an outstanding reading of 71.5 thousand. This blew past the estimate of 9.5 thousand. The estimate for the April reading calls for a decline of 7.2 thousand. The markets will be hoping that the indicator can surprise the markets and post another gain. Despite these excellent employment numbers, the Unemployment Rate did not budge in March, remaining at 5.4%. The estimate for April is unchanged.

AUD/USD Technical Analysis

AUD/USD opened at 1.0448 and touched a high of 1.0497. The pair then dropped, as it dipped below the 1.04 line to a low of 1.0397. The support line of 1.0371 (discussed last week) held firm as the pair weakened. The pair crossed back above the 1.04 line, closing the week at 1.0418.

Technical lines from top to bottom:

We start with resistance at 1.1012. This is followed by 1.0888, which has held firm since August 2011. Next, there is resistance at 1.0789. We next encounter resistance at 1.0739. This line has remained intact, since March 2012, when the Australian dollar started a steep drop which saw it fall well below parity. The is followed by 1.0605. The pair has not tested this line since September. Below, there is resistance at 1.0508. This line was breached in January, when the Aussie commenced a downward trend from which has not fully recovered. The next resistance line is at 1.0416. This line continues to be active, and could be tested if the pair shows any upward momentum.

AUD/USD is receiving at 1.0371. This is a weak line, and was breached last week as the pair dropped as low as the 1.0350 range. This is followed by 1.0326, which has held firm since mid-March. Next, there is support at 1.0260. Below, the pair is receiving support at 1.0174. This line has held steady since early March. We next encounter support at the line of 1.0080, which is protecting the parity level. This is followed by support at the parity line, which has held steady since June and is a psychologically significant barrier. The final support level for now is at 0.9917.

I am neutral on AUD/USD.

Although Australia posted some solid numbers last week, the markets are nervous about developments in Europe and the US. In Europe, there is uncertainty about the ramifications of the Cyprus bailout, while continuing weak numbers out of the US are raising concerns about the recovery. These concerns are not good news for riskier currencies like the Australian dollar. If the US releases rebound this week, we could see the Australian dollar move upwards. On the downside, the markets are expecting weak Australian employment numbers, and if this materializes, the Aussie could lose some ground.

The Aussie sometimes moves in tandem with gold. You can trade binary options on gold using this technical analysis.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.