AUD/USD showed volatility but ended the week unchanged. The pair closed the week at 0.7058. This week has 7 events on the schedule. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Aussie posted strong gains on a disappointing US Services PMI to and strong Australian construction numbers. However, the greenback bounced back late in the week, as Australian Retail Sales came in at a flat 0.0%, well of expectations.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]- ANZ Job Advertisements: Monday, 00:30. This indicator provides a snapshot of the health of the labor market. The indicator posted a decline of 0.1% in December, its first drop in five months. Will we see a reading in positive territory in January?

- NAB Business Confidence: Tuesday, 00:30. The index softened to 3 points in December, down from 5 points a month earlier. The markets are hoping for a rebound in the January report?

- Westpac Consumer Sentiment: Tuesday, 23:30. An increase in consumer confidence can lead to stronger consumer spending, which is an important driver of the economy. The indicator looked dismal in January, coming in at -3.5%. This was the indicator’s weakest reading since September.

- HIA New Home Sales: Wednesday, 00:00. This minor indicator continues to struggle, having posted three consecutive declines. The December release wrapped up 2015 with a disappointing reading of -2.7%.

- MI Inflation Expectations: Thursday, 00:00. Analysts keep a close eye on this event since inflation expectations often translate into actual inflation figures. The indicator softened in December, but was still a respectable 3.6% gain.

- RBA Governor Glenn Stevens Speaks: Thursday, 22:30. Stevens will testify before the House Representatives’ Standing Committee on Economics in Sydney. If Stevens’ remarks are more hawkish than expected, the Australian dollar could move higher.

- Home Loans: Friday, 00:30. Home Loans provides a snapshot of the level of activity in the housing sector. In November, the indicator rebounded with a gain of 1.8%. The upward trend is expected to continue, with an estimate of 2.8%

* All times are GMT

AUD/USD Technical Analysis

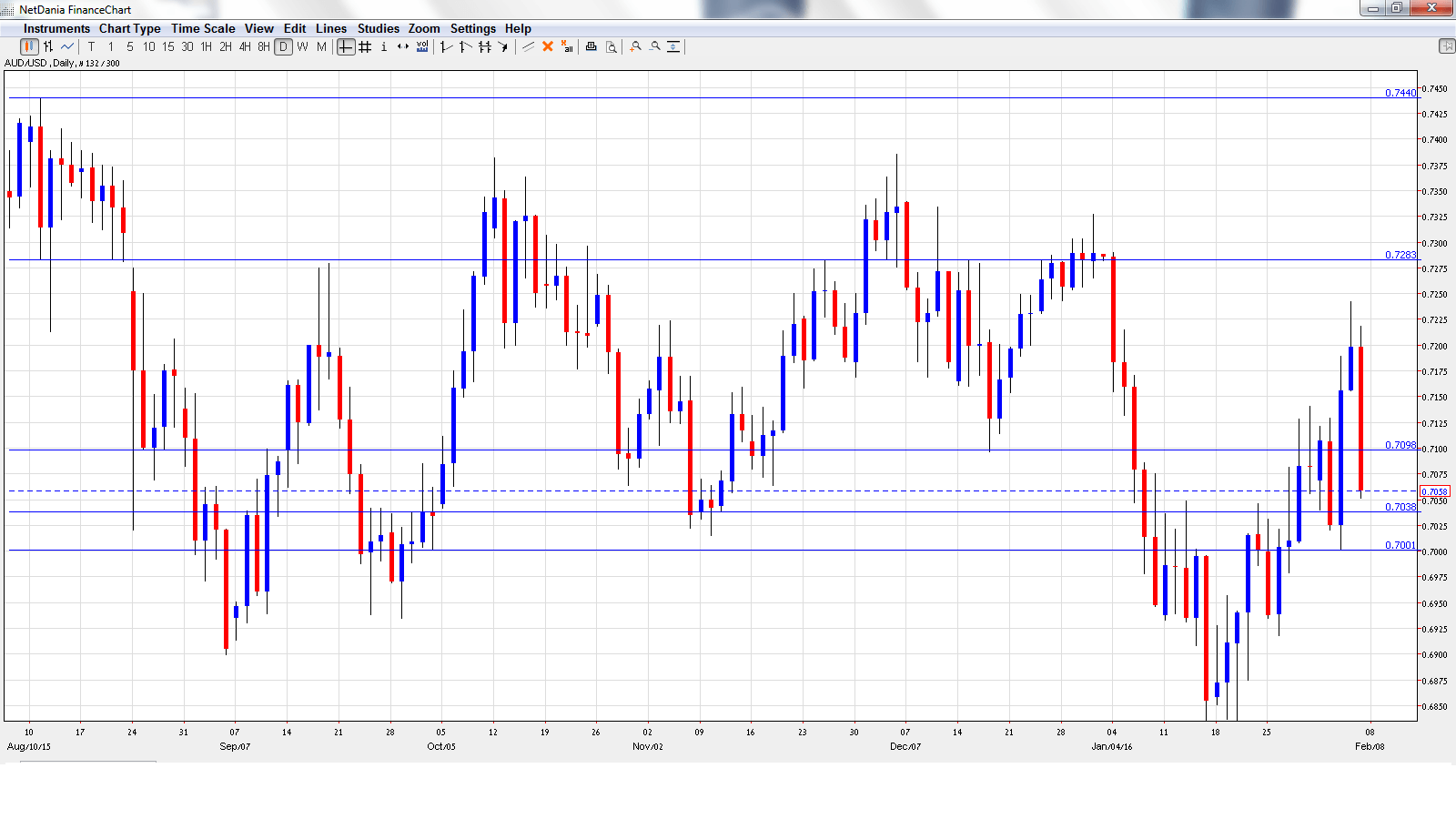

AUD/USD opened the week at 0.7068 and climbed to a high of 0.7242 late in the week, as resistance held at 0.7284 (discussed last week). The pair then reversed directions and dropped sharply to 0.7058.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We begin with resistance at 0.7440. This line capped the pair in August.

0.7284 was tested as the pair posted sharp gains before retracting.

0.7100 had a busy week and is currently a weak resistance line. It could see further action early in the week.

The round number of 0.70 worked as a cushion in August.

0.6899 has provided support since September.

0.6775 is the next support level.

0.6686 was an important cap back in January 2000.

0.6532 is the final support level for now.

I am bearish on AUD/USD

The RBA has sent a clear message that is maintaining a bias towards monetary easing, should inflation levels soften further. Over in the US, the markets are speculating about a March rate hike in the US, a move which would bolster the greenback. This monetary divergence will continue to weigh on the pair.

Our latest podcast is titled Americans get a raise, negativity in Japan, Gas Naturally Low

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast