AUD/USD posted strong gains last week, gaining about 110 points. The pair closed at 0.7220. This week’s key event is Private Capital Expenditure. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Federal Reserve minutes didn’t contain anything new, as the markets eye a possible rate hike in December. US Core Inflation met expectations, with a gain of 1.9%. Over in Australia, the RBA minutes indicated that the central bank is unlikely to lower rates in the near future, despite weaker Chinese growth hampering the Australian economy.

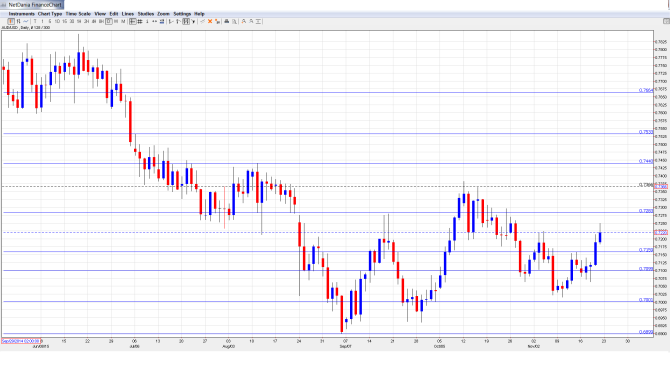

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Governor Glenn Stevens Speaks: Tuesday, 9:05. Stevens will speak at a conference in Sydney. The markets will be looking for clues regarding the RBA’s future monetary policy.

- Construction Work Done: Wednesday, 00:30. This indicator is an important gauge of the strength of the construction sector. The indicator bounced back in Q2, with a respectable gain of 1.6%. This crushed the estimate of -1.5%. The markets are braced for a sharp turnaround in the Q3 report, with an estimate 0f -1.8%. Will the indicator repeat and beat the forecast?

- RBA Assistant Governor Guy Debelle Speaks: Wednesday, 10:20. Debelle will speak at an event in London. A speech which is more hawkish than expected is bullish for the Australian dollar.

- Private Capital Expenditure: Thursday, 00:30. This is the key indicator of the week, and an unexpected reading could have a strong impact on the movement of AUD/USD. The indicator has looked awful recently, has posted declines in the past three quarters, all of which missed expectations. Another decline is expected in Q3, with an estimate of -2.8%.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD started the week at 0.7106 and slipped to a low of 0.7064. The pair then reversed directions and climbed to 0.7250, as resistance held firm at 0.7284 (discussed last week). The pair closed at 0.7220.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

0.7664 remains a strong resistance line.

0.7533 has remained intact since July.

0.7440 capped the pair back in August, and remains key resistance.

0.7284 is the next resistance line.

0.716o was easily breached and has switched to a support role.

0.7100 has strengthened in support following the pair’s gains.

0.70 worked as a cushion in August and is the next support level.

0.69 has provided support since September.

0.6775 is the final line for now. It has provided support since March 2009.

I am neutral on AUD/USD

With speculation rising that the Fed could press the rate trigger in December, the US dollar could post broad gains. At the same time, the RBA has signaled that it has no plans to lower rates, which is positive news for the Aussie. Revisions to the US Preliminary GDP will be released during the week, and this could have an impact on the direction of AUD/USD.

Our latest podcast is titled Between Terror and Thanksgiving:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.