The Australian dollar is under immense pressure, mostly from the crash in Chinese stocks and the overall deterioration in the world’s No. 2 economy, Australia’s No. 1 trading partner.

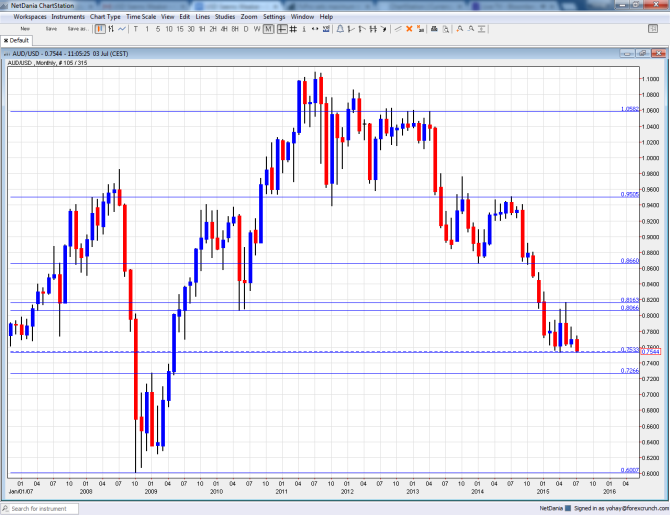

AUD/USD has reached a low of 0.7536, just 4 pips above the previous low of 0.7532 seen on April 2nd. Below this level, we are back to levels last seen in May 2009. Update: the pair dipped to 0.7527, the lowest in 6 years. The break is not confirmed yet.

Data from Australia hasn’t helped too much either. Australian retail sales rose only 0.3% in May, lower than 0.5% that had been expected. In addition, it came on top of small downwards revision for April, a drop of 0.1% instead of flat originally reported.

The Reserve Bank of Australia last cut the interest rates in May, to 2%. In addition, it pledged a period of stability in interest rates. After two nonconsecutive rate cuts this year, the central bank basically said it is enough for now.

More: AUD: Alert But Not Alarmed; How To Trade It? – ANZ

Here is how it looks on the monthly chart. The next support line awaits only at 0.7266, which was a high in early 2009. Below this level, it is a free fall to the height of the financial crisis, all the way to 0.60.

On the upside, we have 0.806 as a big line to the upside, but with many levels in between for the shorter term.

In our latest podcast we feature a Greferendum preview, NFP review and more

Follow us on Sticher.