The Aussie took a big dive, and hardly managed to hold on to parity with the greenback. The upcoming week is quite light in terms of events, but the action will likely continue. Here is an outlook for the Australian events, and an updated technical analysis for AUD/USD.

The ongoing debt crisis in Europe continues to dominate global headlines and weighs heavily on risk currencies such as the Australian dollar. The focus shifted to the Western side of the Mediterranean, with a horrible bond auction in Spain, just before the elections.

Updates: The downfall continues, with AUD/USD falling deep below parity and under 0.99. The Aussie found some support above 0.98, but AUD/USD could break below this line after US GDP was a big disappointment. Risk averse trading hurts the Australian dollar. The Aussie suffered another downfall, caused by the HSBC Manufacturing PMI for China – Australia’s No. 1 trade partner fell into contraction, deeper than earlier and much worse than expected. This sent AUD/USD under 0.98. Next support is 0.97. The terrible German bond auction was felt also in the land down under. The Australian dollar dropped to 0.9662 before recovering. When a safe haven fails, the risky Aussie suffers. With a credit crunch looming over Europe and more credit rating downgrades (now reaching Portugal and Hungary), the risk Aussie continues lower and can test the swing low of 0.9387 on low Thanksgiving liquidity.

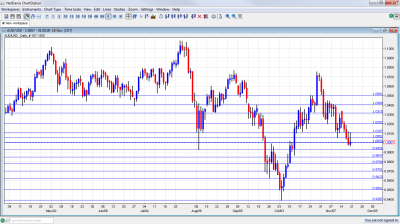

AUD/USD graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Tuesday, 23:00. The Conference Board compiles this index using 7 economic indicators. The index failed to rise in the past rise in the past four months, sliding by 0.1% last time. A similar decline is likely now.

- Construction Work Done: Wednesday, 00:30. Australia’s housing sector is unwinding, to say the least. Last quarter saw a rise of only 0.7% in the amount of construction work performed in the land down under. A rise of 2.1% is expected in Q3, but a weaker figure will not be a huge surprise.

- Chinese HSBC Flash Manufacturing PMI: Wednesday, 2:30. Australia’s No. 1 trade partner is slowing down, but the level of the “Chinese landing” is unknown. After three months of scores under 50 points, this independent measure has shown a rise to 51 points, meaning a return to growth. A resumption of slides is expected now.

* All times are GMT.

AUD/USD Technical Analysis

Aussie/dollar fell quite quickly. Recovery attempts met resistance at 1.02, and later at 1.01 (both discussed last week). After losing parity, the pair eventually closed above this line.

Technical levels from top to bottom:

We start from a lower point this week, after the sharp falls. 1.05 capped the pair twice in October and is also a round number number. 1.04 was a swing low in June and also the peak of a failed recovery attempt in September. It was also a cap in October, and its position is stronger once again.

1.0314 was a stepping stone on the way up many months ago and also a line of support in August. In November is provided some support and some resistance more lately. 1.02, which cushioned a fall during November and then switched positions to resistance is strong again..

1.01 was the area of a cushion around July and also provided support after the recent surge in October, for two weeks in a row. It now turns into resistance after capping a recovery attempt. Before parity, 1.0050, which was a swing low, joins the graph.

The next line is obvious: AUD/USD parity. The very round number has strengthened in September after capping a recovery attempt. It also proved its importance in October. Below parity, 0.9930 is weak resistance after holding back in August.

0.9850, provided support when the Aussie was falling in October and is minor now. The round number of 0.97 provided some support for the pair in September, before falling even lower.

0.9622 was a swing low and served as a springing board for a jump higher. 0.95 held the pair after a swing lower to 0.9387 – the final frontier.

I remain bearish on AUD/USD.

The main reason for being bearish is not Australian economics but the situation in Europe. There is still more room for mess, and the Aussie proved to be very sensitive.

If you are interested in an alternative way of trading currencies, check out the weekly binary options setups, including AUD/USD, EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.