Idea of the Day

We hinted last week that we were seeing something of a sea change in term of underlying sentiment on the Aussie and that has continued this week. Overnight, we’ve seen AUDUSD push above the August high of 0.9233, with marginal help coming from better than expected business confidence data. The July high of 0.9319 is the next focus, but already the charts show that the Aussie has moved from a bear market, interspersed by short upward corrections, to a more bullish one. A change of government is also providing some support in the background, given that it was disappointment on the economy that played a part in undermining the previous labour government at the weekend election. For now, the bearish arguments on the Aussie are looking tired, especially with the latest data on China overnight holding up well.

Data/Event Risks

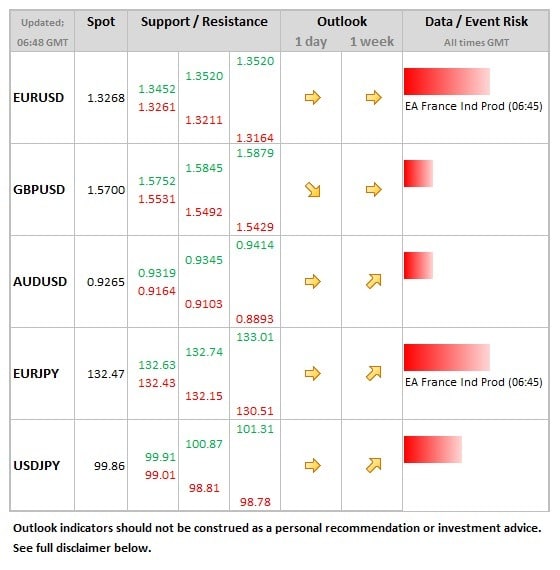

FX: The data calendar very light for FX today, so eyes remain on events in Syria which continues to grab the headlines, but momentum towards air strikes seem to be waning at present.

Latest FX News

JPY: The weaker dollar tone during the European session yesterday meant that USDJPY failed to make a sustained break above the 100 level during European trading.

EUR: The single currency finding a decent but steady bid during the Monday session, pushing up to the 1.3260 area from below 1.32 earlier in the session. No big news events driving the move. More a reflection of the fact that the second most traded currency globally can still attract a decent amount of organic demand.

AUD: Nudging through the August high of 0.9233, but only just and the follow through was very limited during the European session. Data showed improvement in both business conditions and confidence on the basis of the NAB survey, which showed confidence rising to 3.5 year high.

CNY: Overnight data showed industrial production rising 10.4% (from 9.7% in July), whilst retail sales were up 13.4% (from 13.2%). Data was broadly in line with expectations, with the yuan still holding steady to the dollar close to the 6.12 level.

Further reading:

Forex Analysis: AUD/USD Advances to Three-Week High

Tokyo chosen to host 2020 summer Olympics raising new hopes for Japan