Australia’s job report was a big disappointment: instead of seeing no change in the number of jobs, Australia lost 27,000. The unemployment rate rose from 5.1% to 5.2% as expected.

This big disappointment sent AUD/USD to the lowerst level this month, below the high ground it settled on.

In addition, also last month’s figures underwent a downwards revision: from a gain of 38.9K to a gain of only 27.8K. The loss of jobs now erased almost all the gains of the previous month.

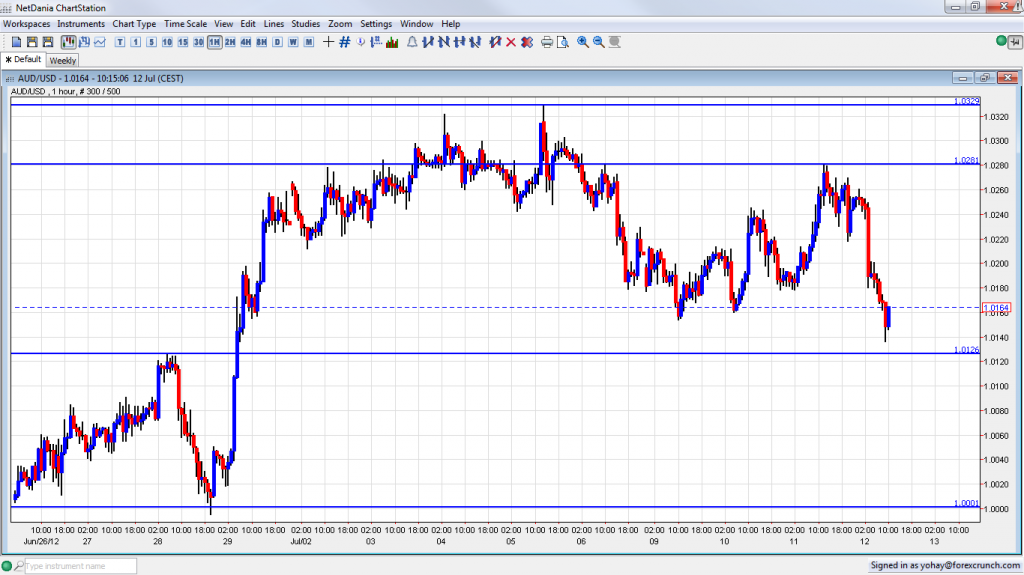

AUD/USD was trading around 1.0240 before the publication and immediately fell under 1.02. The Aussie continued sliding later on and bottomed out at 1.0136.

These levels were last seen on June 29th, just before optimism from the EU Summit sent the pair higher. The euro already more than erased the gains from that summit, but the Aussie was relatively firm. This disappointment is another push lower.

Another big release awaits the Aussie: the publication of Chinese GDP for Q2. China is Australia’s main trade partner.

See how to trade this event with AUD/USD.

It’s interesting to note that Australia’s Prime Minister, Julia Gillard, said that the employment situation in Australia and its economy are still great, an envy to the world. Indeed, an unemployment rate of 5.2% is very low, and Australia is considered one of the best places to live in.

Nevertheless, what matters for currencies is the most recent news – and this piece of news about jobs was negative.