- BTC/USD is poised for further rises, with the initial hurdle only at $7,256.

- ETH/USD needs to break above $297 to surge to higher ground.

- XRP/USD targets 0.3625 but has some hurdles on the way.

Cryptocurrencies continue consolidating the significant gains with some gentle upwards movements. What’s next? We see a cleaner path for Bitcoin, one hurdle for Ethereum, and a more challenging path for Ripple. The good news for all three digital coins is that they are all well supported. Corrections may be limited in scope and temporary.

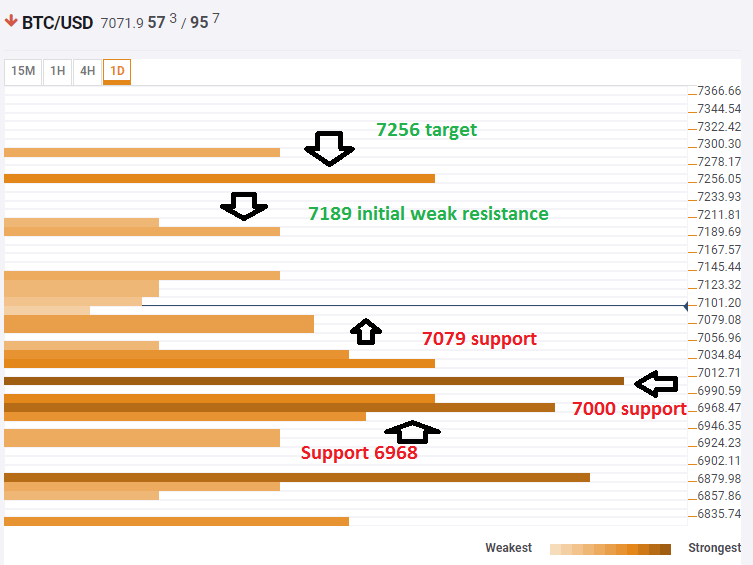

BTC/USD 1 D

Bitcoin has minor resistance at $7,189 which is the convergence of the Pivot Point one-day Resistance 1 and the Bolinger Band 4h-Upper. However, the more serious resistance is at $7,256 which is the Pivot Point one-week Resistance 2, a potent line. Beyond this level, there are no notable lines until at least $7,366.

More significant technical lines are waiting below to provide support to the BTC/USD. An immediate cushion awaits at $7,079 which is the congestion of the BB 15m-Lower, the BB one-hour Middle, the Simple Moving Average 5-4h, the SMA 10-1h, the Fibonacci 23.6% one-day, the SMA 100-15, and the SMA 50-15m.

The powerful Fibonacci 61.8% one-month awaits at around $7,000. Close by, we find $6,968 which is the confluence of the PP one-week R1, BB one-day Upper, the Fibonacci 61.8% one-day, and the SMA 50-oned-ay, the SMA 50 one-hour, and the SMA 200-15m.

Click to see the Full Confluence Indicator

Here is how it looks on the tool:

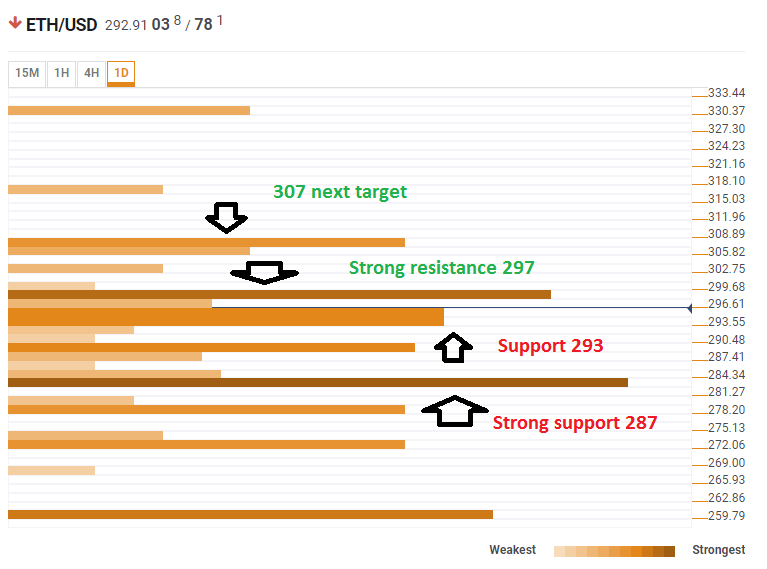

ETH/USD 1D

The $297 level looms over Ethereum. It is the confluence of the potent BB 1h-Upper, the PP one-month S3, the one-day high, the SMA 5-15m, the SMA 10-15m, the 4h-high, and the BB 15m-Upper.

The next convergence is already much weaker. At $307 we find the meeting point of last week’s high, the PP one-day R2, and the PP one-week R1.

Looking down, the ETH/USD has immediate support at $293 which is the meeting point of the BB 1h-Middle, the Fibonacci 23.6% 1d, the BB 1d-Middle, the BB 15m-Middle, the SMA 5-1h, the Fibonacci 38.2% one-day, the SMA 100-15m, the BB 15m-Lower, the SMA 50-15m, the SMA 10-1h, and the SMA 5-4h.

The next support level is at $282 which is the convergence of the SMA 100-1h, the SMA 10-one-day, the BB 4h-Middle, and the one-day low.

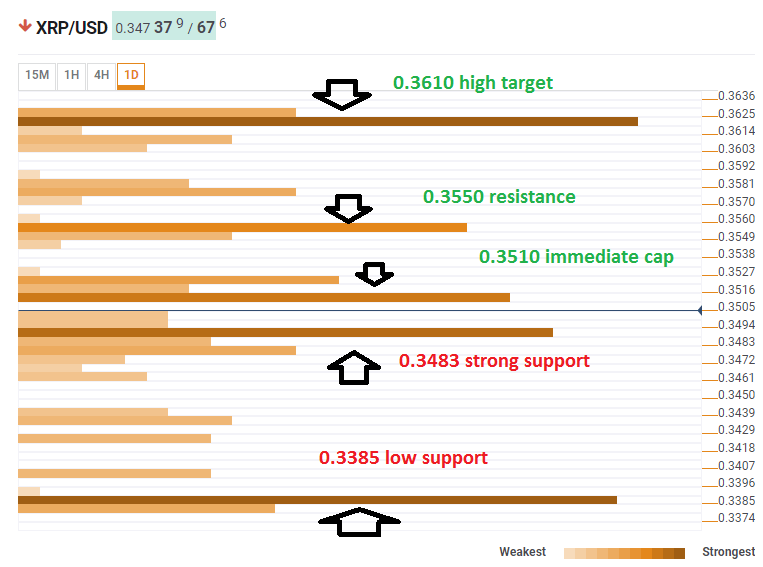

Ripple has to surpass $0.3510 to rally. This is the convergence of the potent Pivot Point one-week Resistance 1, the one-hour low, the SMA 10-15m, and the Fibonacci 23.6% one-day.

Next up we see 0.3550 as the confluence level of last week’s high, the BB one-hour Upper, and the BB 15m-Upper.

The target for the XRP/USD is $0.3610 which is the meeting point of the all-important Pivot Point one-month Support 2 and also the SMA 200-4h.

Immediate support awaits at $0.3483 which is the confluence of the SMA 5-4h, the Fibonacci 38.2% one-day, the BB 15m-Middle, the SMA 100-15m, and the BB one-hour Middle.

If Ripple loses that level, the next significant cushion is only far lower, at $0.3385 which is the convergence of the PP one-day S1 and the Fibonacci 61.8%.

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto , and our FXStreet Crypto Trading Telegram channel

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.