- Bitcoin Cash price extends intraday declines, drops 8% on Tuesday.

- The critical support at $480 must not be broken, or else BCH/USD could take another trip heading for $400.

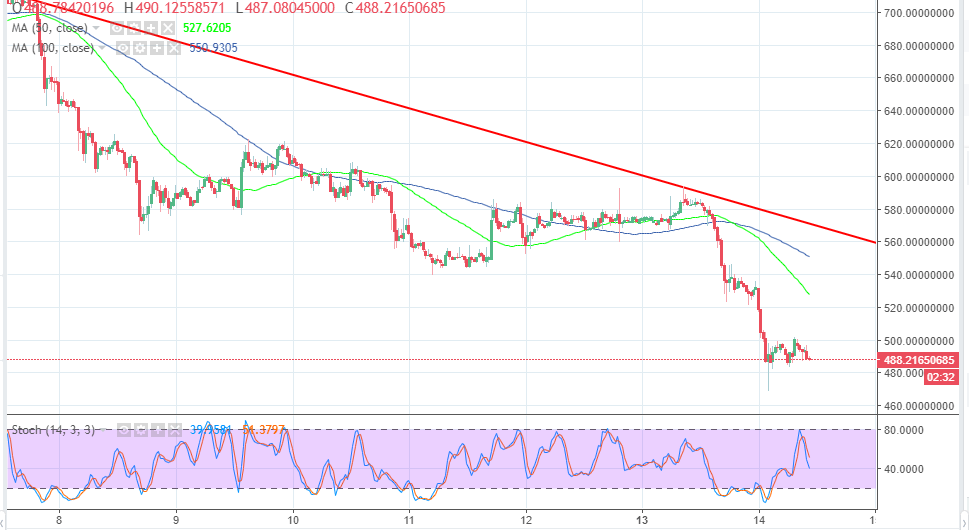

The daily chart for Bitcoin Cash shows that Bitcoin Cash is back to trading October 2017 levels before the rally that took off at the begging of November. BCH/USD has slashed over 8% of its value on the day. Moreover, it is apparent that the declines are far from over because of the ongoing bear reaction to the bulls failure to clear the resistance at $500.

The former support at $540 held ground over the weekend but the higher corrections that followed lost momentum marginally above $580. Bitcoin remained range bound within the upper limit at $580 and the lower limit at $560 from Sunday 12 until yesterday. The buyers initiated a recovery trend above $570, retraced above $580 but stalled above $590. This gave the bears an entry, and this time the fall was massive, smashing through the supports $560, 540, $520 did little to slow the momentum and finally plunged below $500.

Although the buyers found balance above $480 on Tuesday morning (

BCH/USD hourly chart