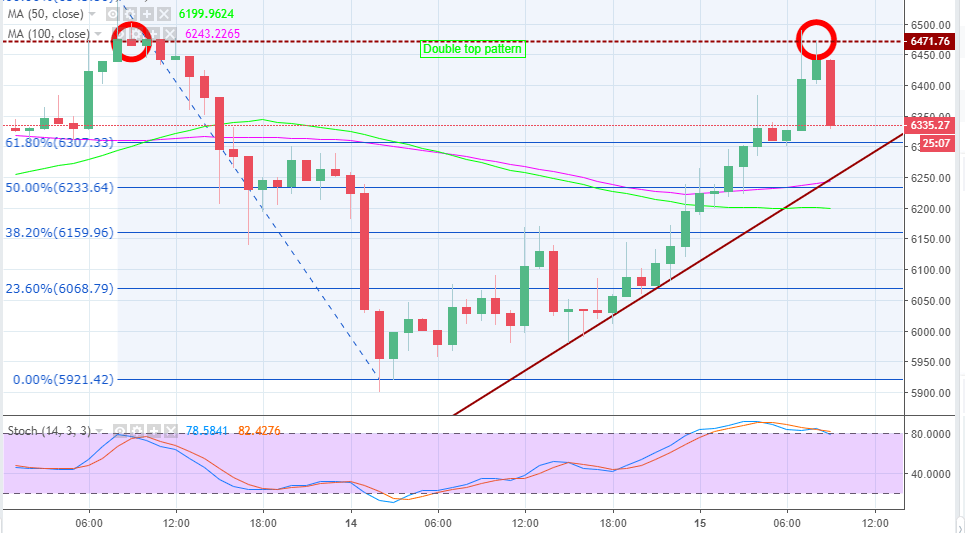

- Bitcoin recovered from the pits above $6,000, but the double top reaction is canceling gains towards $6,300.

- The 61.8% Fib support marginally above $6,300 has to hold to prevent further breakdown towards $6,200.

Bitcoin staged a divergence marginally above the primary support at $6,000 in the hours before the close of the session yesterday. The trend has remained bullish as buyers maintain control over the price on Wednesday 15. BTC/USD had recovered above the 61.8% Fibonacci retracement level with the last swing high of $6,545.86 and a low of $5,921.42 slightly above $6,300 in the analysis published earlier on the day.

There was a struggle at $6,330 but the bearish corrections were supported above $6,300. At the time of writing the price has broken the support at $6,400 and testing the next immediate support at $6,350.

The critical resistance is at $6,500 coins while the formation of a double-top pattern as seen on the hourly chart has led to lower corrections below $6,400. If the buyers have strength to push the price back above $6,400, the sustain uptrend could ignore the double-top pattern effect. However, downward pullback is apparent and $6,300 support is well within reach.

The stochastic oscillator has been in the overbought region since the trading began today. This means that the buyers have a tight grip on the price or they could be exhausted and the sellers will eventually find an entry. A support above $6,350 is importance while $6,300 (61.8% Fib) support is crucial

In other news, it is reported that at least 18,000 BTC was transferred to BitMex wallet. This happen hours before the market started experienced the recovery in Bitcoin. The colossal BTC came from at least 17 wallets. The first wallet sent 10 BTC at 4.50 am New York Time. Significantly, thirty minutes later, 16 other wallets transferred 17,990 BTC to the same BitMEX wallet making a grand total of 18, 000 BTC.

There was short firestorm on Twitter as the crypto community speculated that a whale was moving the money, or even worse it was BitMEX trying to manipulate Bitcoin price. However, the transfer is not at all tailored at manipulating the price, but it could a normal funds movement from cold storage on BitMEX part. Such events have occurred before with Bithumb and other crypto exchanges and it is outrageous to say that BitMEX is manipulating the market since the 18,000 BTC is not event 0.1% of the total BTC coins in circulation.