- Cryptocurrency market is recovering from recent lows.

- CBOE and VanEck hope for positive SEC’s decision.

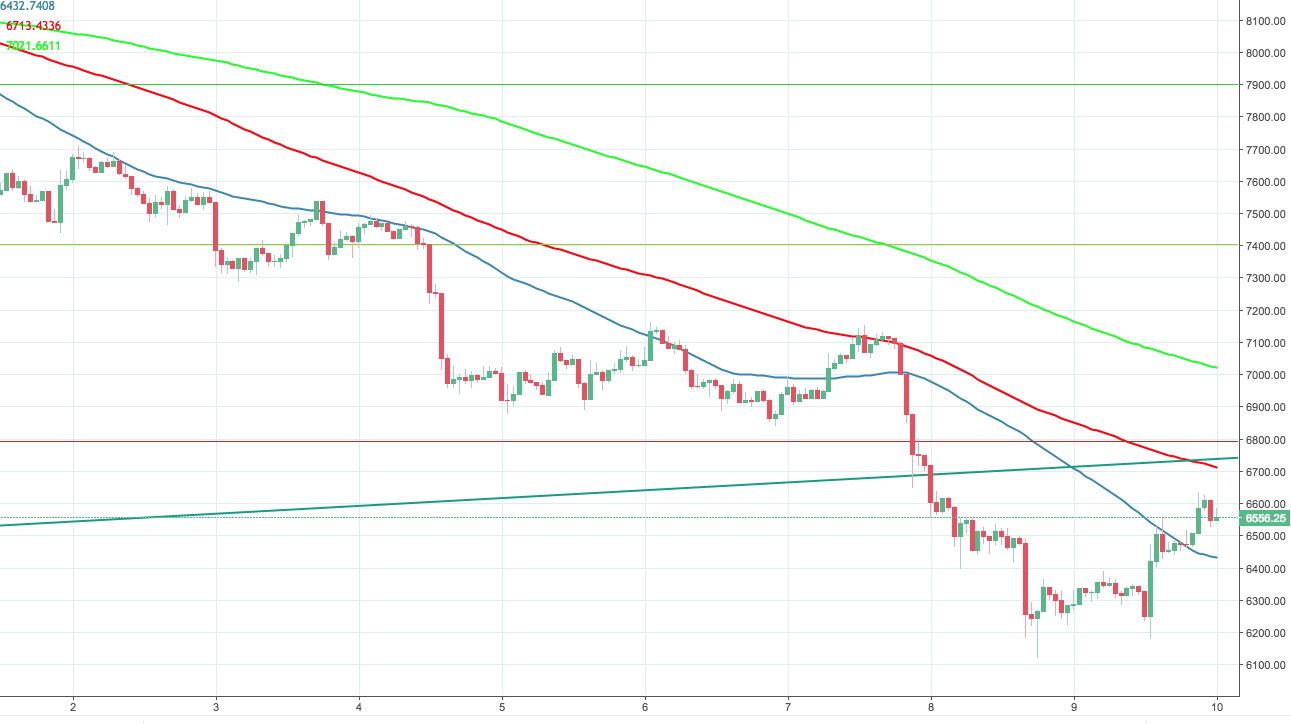

BTC/USD is changing hands at $6,556, 2.8% higher on a daily basis as the cryptocurrency market recovers from the overbought territory. The largest digital coin lost about 10% of its value on Wednesday amid global concerns about SEC’s decision to delay the verdict on Bitcoin ETF.

While the upside momentum is building mostly on technical and speculative factors, it is also supported by the rumors that CBOE and VanEck management has no doubts that the regulator will eventually approve the ETF.

“Our team expected this delay, almost to the hour, and has been an expectation in our planning process. We won’t say when we expect an approval, but there has been specific speculation that we actually agree with and have incorporated into our timeline. We are in no way surprised by this. Most importantly, we believe our submission is the strongest yet to be put in front of US regulators, and believe that strength will be rewarded,” VanEck representative commented in an email message to The ICO Journal.

Some profit-taking ahead of the weekend may push BTC a bit higher, though, there is a cluster of strong technical levels to be cleared before this recovery gets “sustainable” status. Namely. $6,700 handle closely followed by SMA100 – 1hour at $6,713 and the broken upside trendline are likely to discourage the bulls for the time being. On the upside, the fists support is seen at 6,432 (SMA50 – 1hour) followed by 6,300.

BTC/USD, 1-hour chart