Despite better than expected employment figures, the Canadian dollar ended the week on a sad note. And now, all eyes are on the Bank of Canada. To cut or not to cut?

The team at Credit Agricole weighs in:

Here is their view, courtesy of eFXnews:

The BoC meets next week and is widely expected to remain on hold.The OIS market is pricing in a 5bp move, which translates into a tad over 20% chance of a 25bp cut.

We think the BoC will keep its powder dry ahead of the election in mid-October. However, we have recently changed our call and expect the BoC to cut at the October meeting when it presents a more sober MPR. This is based on two drivers: oil and data.

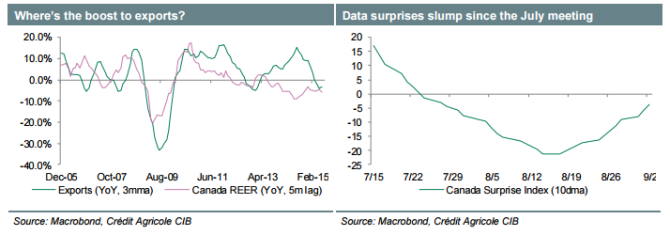

First, recall that at the July MPR the BoC painted an upbeat picture about the outlook for oil. Specifically, its forecast assumes oil prices near USD60/bbl while also expecting a significant tightening between Canadian oil (WCS) and US (WTI).

Second, the data argues that fresh action is needed. Indeed, data releases since the last meeting showed the economy remains weak, with growth stumbling in H1. The economy technically entered a recession in Q2, dropping an average 0.65% in H1. Canada’s data surprised index also shows overall weakness since July.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.