The headline trade balance figure of +60.34 USD hides the true story: Chinese imports fell for the 11th consecutive month. In US dollar terms, China saw a fall of 20.4% y/y, worse than 16% expected and 13.8%. Exports dropped “only” 3.7% y/y, actually better than 6% predicted.

The import story is not good news for Australia which exports to China. The Australian dollar reacted:

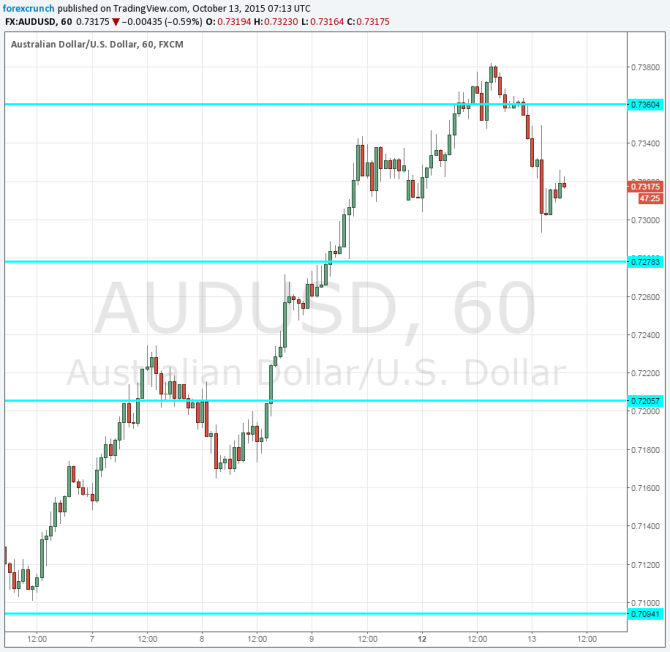

AUD/USD slid from highs and dipped under 0.73 before stabilizing. The 0.74 level continues capping the pair. On the downside, the post Fed high of 0.7277 provides support.

Together with the news from China, also copper prices lost some ground from the highs, and this adds to the pressure on the Aussie.

Australia still relies heavily on commodity exports to China. Low rates for longer in the US help AUD/USD stay on higher ground, but this cannot help it fly. While part of the drop in Chinese imports is related to the drop in commodity prices, a significant portion is an outright slowdown.

More: AUD/USD targeting 38.2% Fibo, – JP Morgan