The US dollar has been hit by a dovish interpretation of Janet Yellen’s words and by some kind of correction.

Nevertheless, the team at ANZ still sees a case for staying strategically bullish on the greenback, and explains why:

Here is their view, courtesy of eFXnews:

Despite recent setbacks, the USD is continuing to receive an image upgrade, says Australia and New Zealand Banking Group (ANZ).

“Consider the news events of note since the beginning of the year: 1- Easings from a range of central banks – which now numbers close to 20 by our count; 2- Concerns about the creditworthiness of 1MDB in Malaysia; 4- For the euro area – the ongoing focus on Greece; 3-The apparent acceleration in capital outflows from China; and 5- Some press reports questioning the longevity of Australia’s AAA credit rating,” ANZ notes.

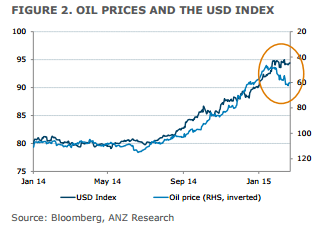

“The upward correction in oil prices and signalling that the Fed retains some uncertainty about the broader environment and hence caution over the timing of the first rate hike, are contributing to what has been a rangy and idiosyncratic tone to currency markets,” ANZ argues.

“More broadly however, US economic outperformance is still strong, US monetary conditions are tightening, and sensitivity to tighter USD liquidity remains high (particularly in emerging markets),” ANZ adds.

“As such, strategically we retain a strong USD bias,” ANZ advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.