The euro has certainly fallen, but this isn’t reflected in inflation. Will Draghi call for patience, expressing optimism but risking a rise in the value of the euro? Or will he keep pushing the “ready to do more” mantra and hit the euro when it’s down, sending EUR/USD to the comfort zone closer to 1.20?

Follow a live blog of the event here.

Here is a preview of the Draghi show, listing 5 topics to watch out for.

Background

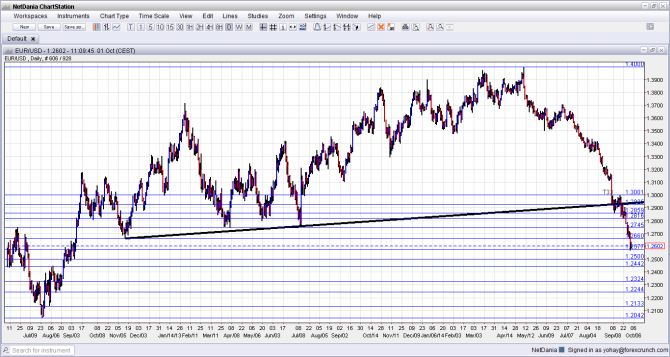

Monetary policy divergence is certainly reflected in the markets. This chart speaks for itself:

Basically, the ECB is set to keep low rates for at least two more years, and expand its balance sheet, while the Fed is about to end its balance sheet expansion (QE3) and raise the rates in 2015.

After the ECB surprised with further measures in September (after the big steps in June), the euro continued falling. The US dollar also reacted to upcoming tightening, despite seeing some unconvincing figures, namely August’s weak NFP. EUR/USD is consistently falling, making only “dead cat” bounces on the way.

Euro-zone woes

The euro-zone experienced flat growth in Q2, with Germany contracting by 0.2%. German PMIs did not foresee this fall, and the most recent manufacturing PMI from the zone’s locomotive is now in contraction. In addition, business confidence is falling and unemployment is rising.

France isn’t in a better state: the second largest economy suffered a political crisis, refuses to reform and hasn’t seen growth in a long time.

The old continent is still experiencing low inflation. CPI is at 0.3% and core CPI at 0.7%, both are at the cycle lows. While both have already been at these levels, it hasn’t happened together until now. German inflation is at 0.8% and Spain continues suffering from outright deflation.

Inflation comes via lower energy prices, glut resulting from sanctions on Russia and counter sanctions and the higher lending from banks is only marginal so far – it does not contribute to stronger inflation.

The first move to enlarge the balance sheet came from the first installment of the ECB’s targeted loans, known as TLTROs. The reception was poor: nobody wanted Draghi’s money, or to be precise: only €82.6 billion were taken up, below all estimates. This raises expectations for more steps and triggers even more worries about the economies of the euro zone.

ECB toolbox

What is the ECB going to do now? Well, probably nothing. It did so much in September and declared that interest rates as having reached their lower bound, that no action is expected now.

So, it all depends on Draghi’s words. Here are the topics:

- Details on ABS: Draghi may lay out a timetable, provide more details about the instruments and perhaps other technicalities. However, he may probably refrain from disclosing the size the ABS, sticking to the “sizable” wording and aim for a 1 trillion euro expansion of the balances sheet, TLTROs included.If he does mention a number and it’s big, the result is likely to be euro negative. A small size is euro positive. Without a number, the markets will move along.

- View on inflation: On one hand, inflation is at rock bottom levels. On the other hand, the low euro could eventually be reflected in higher inflation, especially of that coming from imported goods. Draghi is likely to continue denying deflation, and the markets are going to move along. However, if he does warn of deflation danger, the euro is likely to crash.

- View on bank lending: In some countries, notably in Spain, a better lending environment is already reality. But, these are only green shoots, and the TLTRO take up was poor. Draghi is likely to express optimism about the next TLTRO and call on governments to do more, as always. However, if Draghi is worried about this, the euro is likely to fall.

- Open door to QE: While Draghi would prefer avoiding outright QE (buying government bonds) due to German opposition, he still could need to use it or at least wave with this option to markets for a long time. He is likely to leave an open door to QE. If he surprises by closing the door, the euro is likely to leap.

- View on the exchange rate: Since May, EUR/USD fell around 10%, and the euro lost ground also to the pound. Draghi is probably smiling inside. However, the ECB doesn’t officially have an exchange rate target, and Draghi is likely to be very careful here. He could still mention the exchange rate as an impediment. A lower euro is necessary to lift inflation, lift exports and to avoid outright QE. A EUR/USD value of under 1.20 is probably too much for the ECB, but until we get there, Draghi is more likely than not to hit the euro when it’s down, taking a page from the RBNZ. He could therefore express general worries about the euro-zone economies and mention the exchange rate together with geopolitical risks, as he did in the past.

What do you think? Will the euro suffer from Draghi’s heavy hand once again? Or will it finally recover?

In our latest podcast, we discuss the big events for October: