Mario Draghi said his word and sent the euro down. What does this mean in the long run?

The team at Danske explains why the ECB will extend its QE program beyond 2016:

Here is their view, courtesy of eFXnews:

ECB president Mario Draghi was very dovish at today’s ECB meeting and we now expect the ECB to extend QE purchases beyond September 2016. Our changed expectation comes mainly as the ECB projects headline inflation will be only around 0.9% in Q2 16 and 1.2% in Q3 16 when the ECB is set to end QE purchases. In our view, the ECB will continue its purchases if inflation is around these levels, as the ECB also forecasts inflation will increase to only 1.5% in Q4 16.

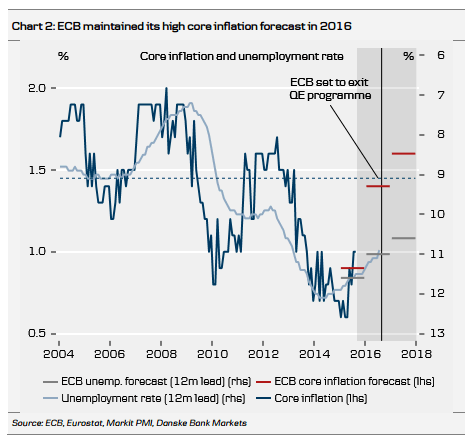

While the ECB lowered its headline inflation projection for 2016 by 0.4pp to 1.1%, it kept its core inflation forecast for 2016 unchanged at 1.4%. We continue to believe the ECB is too optimistic on its outlook for core inflation, as slack in the labour market will still be a headwind to higher wage growth in 2016. Hence, we do not see it as very likely that core inflation will increase very close to its historical average of just below 1.5% as the ECB expects. In our view, the ECB will lower its core inflation forecast in December this year or in March next year, which would then be followed by another round of dovish comments from Draghi and eventually more easing.

Further easing could also follow if sentiment in the euro area deteriorates on the back of the uncertainty in China and emerging markets. Today’s message from the ECB was that it is too early for the ECB to conclude whether or not more easing is needed on the back of the latest uncertainty. In terms of timing, the amount of data ahead of the October ECB meeting is limited (see timeline below) and we believe it is likely the ECB will stay on hold until the December meeting and possibly stick to verbal intervention until 2016.

In terms of available instruments, Draghi put most focus on the flexibility of the QE programme, as he emphasised it could be extended beyond September 2016 and/or the ECB could increase monthly purchases. In terms of further cuts in policy rates, Draghi said that the ECB did not discuss whether it had reached the lower bound on policy rates and based on this we stick to our expectation that it is more likely that the ECB will extend its QE programme than that it will cut policy rates.

The dovish message was well received by the market, with a broad-based rally in fixed income driven by the 5Y and 10Y segment. We interpret the reaction to the change in the ISIN limits as well as the Governing Council judging it ‘premature’ to conclude on the downside effects on growth and inflation expectations as the market building up expectations for the QE programme to be scaled up or extended. In our view, this is a signal Draghi clearly wanted to send.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.