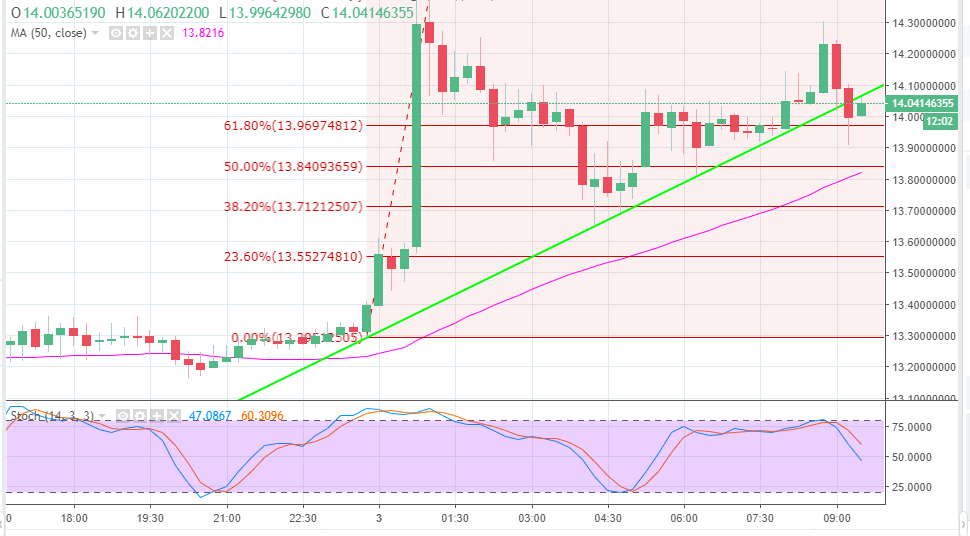

- Ethereum Classic defies market’s bear trend to surge above $14.00 resistance.

- Support is highlighted by the 38.2% Fib level and 15-minutes 50SMA currently at $13.82.

The cryptocurrency market is generally in the red today except for selected digital assets like Ethereum Classic (ETC) and Monero (XMR), which are trading in the green (at least for the top 20 coins). Bitcoin (BTC), for instance, is trimming gains after trading above $7,300 between yesterday and today (Asian trading hours). Ethereum (ETH) is locked below $300 while Ripple closes the top three digital assets with a 2% drop on the day.

Ethereum Classic, on the other hand, opened the day’s trading at $13.39 before a spike in an engulfing candle. The uptrend was initiated from the support at $13.10 during the trading session yesterday. The spike during the Asian trading hours had ETC/USD jump above the resistance at $14.00. The momentum, however, stalled slightly above $14.30 but formed intraday highs of $14.374 before lower corrections swept in.

The declines have been supported at the 38.2% Fibonacci level of the drop from $14.38 to a low of $13.29, which coincides with the trendline support. Upside retracement above this support remains range-bound below $14.30. There has been a subtle slide below the trendline support $14.04 but the buyers are battling to pull back the price towards $14.50.

The outlook of the chart is still positive; the RSI is beginning to change direction upwards while the stochastic is heading south but the slope is mild. The initial resistance is at the 1st supply zone ($14.24) and the upper supply zone at $14.347.

ETC/USD 15-minutes chart