EUR/USD shot higher on a mix of Greek hopes and USD weakness. The move accelerated as stops were triggered.

The team at RBS discusses positioning and what it means for EUR/USD:

Here is their view, courtesy of eFXnews:

“The sharp rally in the EUR suggests that short positions remain large and the market is susceptible to a squeeze on relatively small improvements in its outlook. As discussed yesterday, the IMM futures positioning data reported for last Tuesday do suggest positions remain large.

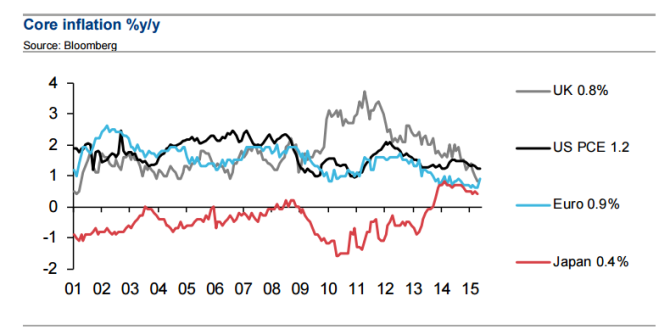

It may take some time before there is a clear shift back to a persistent weakening trend in the EUR…We see risk of a more significant clean-out of short EUR positions, particularly if US data this week does not display clear evidence of recovery gaining traction. The narrowing inflation differential between the US and the Eurozone may make participants question holding short EUR positions. Greece debt negotiations remain influx and add to skittishness.”

Greg Gibbs – RBS

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.