Technical Bias: Bearish

Key Takeaways

“¢ Euro traded lower against the Canadian dollar as the market sentiment titled in favor of sellers.

“¢ 1.4550 resistance level holds a lot of importance, as if the EURCAD pair fails to break it, then it might continue trading lower.

“¢ EURCAD support seen at 1.4500 and resistance ahead at 1.4550.

The Euro looks poised for declines unless the 1.4550 level gives way, as a break above the mentioned resistance level could open the doors for further upside acceleration.

Technical Analysis

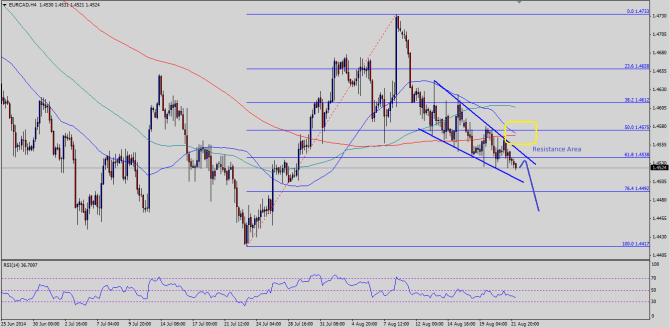

There is an important contracting triangle formed on the 4 hour timeframe for the EURCAD pair, which might act as a catalyst in the short term. The mentioned triangle is on the verge of a break. On the upside, the triangle resistance is around the 1.4550 level. The possibility of a break lower is high as the pair is trading below all three crucial simple moving averages (200, 100 and 50). So, this might provide a reason for the Euro sellers to take the pair lower. On the downside, initial support can be seen around the triangle support area of 1.4500, which is just above the 76.4% Fibonacci retracement level of the last leg higher from the 1.4417 low to 1.4733 high. A break below could set the pair for a run towards the last swing low of 1.4417.

On the other hand, if the pair manages to clear the 1.4550 resistance level, then a move towards the 1.4600 level might be on the cards. However, a break above the triangle would be a strong bullish call, which might take the pair towards the last swing high of 1.4680.

Canadian Inflation Data

There is an important risk event lined up later in the Canada today. The Canadian consumer price index and retail sales data will be published by the Statistics Canada. If the outcome comes in line with the expectation, then the Canadian dollar might gain traction moving ahead.