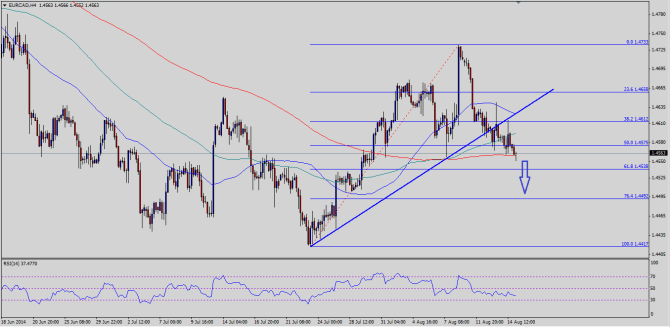

Technical Bias: Bearish

Key Takeaways

“¢ Euro is trading lower against the Canadian dollar, as the Euro bears take control.

“¢ 1.4560 is an important support level and if sellers manage to break it, then more losses are possible in the EURCAD pair.

“¢ EURCAD support seen at 1.4560 and resistance ahead at 1.4600.

The Euro continued its decline against the Canadian dollar, but we need to keep a close eye on the 1.4560 support area for a break lower.

Technical Analysis

There was an important bullish trend line formed on the 4 hour timeframe for the EURCAD pair, which was broken earlier during this week. This break can be considered as very critical, as the pair is now trading below the 100 and 50 simple moving averages. Moreover, it has also breached the 50% Fibonacci retracement level of the last move higher from the 1.4417 low to 1.4733 high. However, there is one more side of the story, which is the importance of 200 SMA (4H). The pair is trading around the 200 SMA (4H) and struggling to break the 1.4560 level. If the Euro sellers manage to break the mentioned level, then a move towards the 1.4492 level is possible in the short term. The 4 hour RSI is below the 50 mark, which supports the bearish view for now.

Alternatively, there is a chance that the pair might rise from the current levels, then in that situation initial resistance can be seen around the 100 SMA (4H), which is currently at 1.4600. Any further gains might see sellers around the 50 SMA (4H), which also coincides with the broken trend line.

Moving Ahead

Overall, there are a lot of hurdles on the way up for the pair. So, the possibility of a break below the 200 SMA (4H) is more compared to a move higher. Ahead, selling rallies might be a good idea in the short term.