Technical Bias: Neutral

Key Takeaways

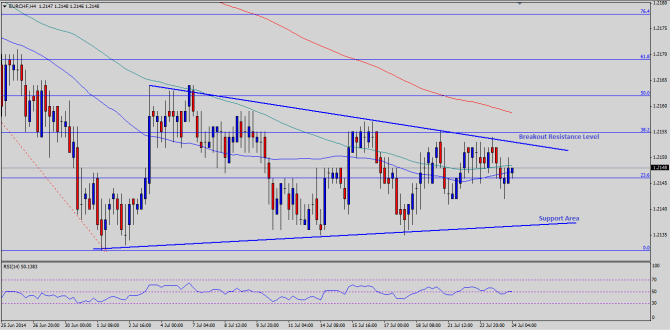

“¢ Euro continues to consolidate against the Swiss franc in a tight 20 pips range.

“¢ Euro zone manufacturing and services PMI could act as a driver for a break in the EURCHF pair.

“¢ EURCHF support seen at 1.2135 and resistance ahead at 1.2155.

The Euro buyers have struggled time and again to take the shared currency higher against the Swiss franc. However, the EURCHF pair is forming a short-term breakout pattern, which might define trend moving ahead.

Technical Analysis

There is a monster contracting triangle formed on the 4 hour timeframe for the EURCHF pair with resistance around the 1.2135 level. The pair has failed on a number of occasions to break the triangle resistance trend line, as the Euro sellers remain active against other major currencies. That puts a lot of pressure on the EURCHF pair, and as a result the pair has failed to gain any upside momentum. However, it looks like that the pair is forming a base around the 1.2130-35 support level. On the upside, the triangle resistance trend line is now coinciding with the 38.2% fib retracement level of the last drop from the 1.2192 high to 1.2132 low. So, a break above the 1.2155 level might expose a run towards the 50% fib level. However, the 200 simple moving average also sits above the 38.2% fib level, which could act as a barrier moving ahead.

Euro Zone Manufacturing And Services PMI

Today during the London session, a lot of important economic releases are lined up, including the Euro zone manufacturing and services PMI. If the outcome exceeds the expectation, then the Euro might gain traction in the short term. EUR/USD already lost ground towards this release.

Overall, as long as the pair is trading above the 1.2135 level a break above the 1.2155 cannot be denied, which could take the pair back towards the 1.2180-90 resistance zone.