The Euro headed lower against a few major currencies during this past week, including the Japanese yen. The Euro remains under severe bearish pressure and that is the reason why it might move lower in the short term. There was an important support for the EURJPY pair which was breached earlier, which has raised the case for more downside in the near term. The German IFO business climate index will be released later during the London session, which is expected to register a minor improvement this time. If the outcome misses the forecast, then the Euro sellers might take control in the near term.

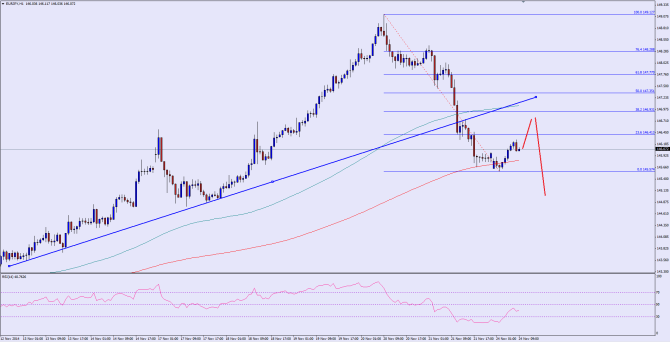

There was a monster bullish trend line formed on the hourly chart of the EURJPY pair, which was broken recently. This break was crucial, as it has opened the doors for more downside towards the 144.00 area. The pair is currently struggling to break the 200 hourly moving average, which is a positive sign as of now. So, there is a chance of a correction in the short term, which might take the pair towards the 38.2% fib retracement level of the last drop from the 149.12 high to 145.57 low, which also coincides with the broken trend line. Moreover, the 100 hourly moving average is also sitting around the mentioned resistance area.

On the downside, initial support is around the 200 MA. We need to see how long the EURJPY pair can manage to hold the downside. A break below the same might take it towards 144.00.

Overall, one might consider selling rallies as long as the pair is trading below the broken trend line.

————————————-

Posted By IKOFX Technical Team: Online Forex Broker