The Euro has declined heavily against most major currencies during the last several days, including against the Japanese yen. The EURJPY pair recently traded towards the 136.40 support area where the Euro buyers managed to take the pair higher. The pair is now trading a touch higher during this week. There were a few important economic releases lined up during the London session, including the German GDP data. The market was expecting a 0.2% decline this time around. The outcome was in line with the expectation. The Euro was seen trading a touch higher after the release.

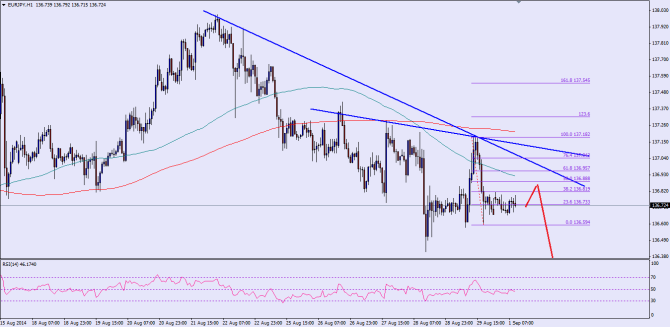

There are a couple of important bearish trend lines formed on the hourly chart of the EURJPY pair, which are acting as a hurdle for the pair on the high side. The pair looks like consolidating as of writing, and there is a chance of a short term spike higher. However, if that happens, then the pair might find resistance around the 50%

Fibonacci retracement level of the last move lower from the 137.18 high to 136.59 low. The most important point is that the mentioned fib level is just below the 100 hourly moving average and the bearish trend line. So, there is a lot of resistance around the 136.80-90 levels. If the pair trades near the mentioned level, then it is likely to find sellers in the short term.

On the other hand, if the Euro manages to break the first bearish trend line, then a test of the next trend line is possible. On the downside, an initial support can be seen around the 136.54 level, followed by the 136.30 level.

Overall, selling rallies remain a good option in the near term until the pair is trading below the highlighted bearish trend lines.

————————————-

Posted By Simon Ji of IKOFX