The Euro traded lower recently against the Japanese yen and tested the 130.10-00 support area. It is currently retracing higher, but heading towards an important resistance area. Earlier today, the Japanese Merchandise Trade Balance Total was released by the Ministry of Finance. The outcome was a touch better as the trade deficit was around ¥-660.7B whereas the market was expecting it to be around ¥-740.3B. Moreover, the Japanese Exports of goods and services, released by Japan Customs managed to register an increase of 12.96%. However, the imports were on the lower side compared with the expectation of 2.3% increase it came in at 1.9%.

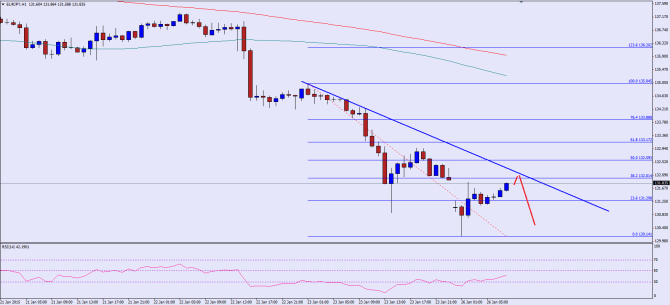

There is a monster bearish trend line formed on the hourly chart of the EURJPY pair, which might act as a catalyst for the pair in the near term. Currently, the pair is testing the 38.2% fib retracement level of the last drop from the 135.04 high to 130.14 low. However, the most important resistance is around the highlighted trend line. There is a chance that the pair might struggle to clear the 132.20-30 area and continue trading lower. The hourly RSI is still below the 50 level, which is a discouraging sign. A break above the trend line could be a bullish call for the Euro buyers and the pair might climb higher in that situation.

On the downside, the recent low of 130.14 might act as a support. A break below the same might call for more downsides in the near term.

Overall, one might consider selling rallies in the EURJPY pair as long as it is trading below the highlighted trend line.

————————————-

Posted By Simon Ji of IKOFX Techni