The Euro was seen trading lower against the Japanese yen, as buyers struggled to take the shared currency higher. There are several hurdles on the way up for the EURJPY pair, which prevented upside in the pair every time it traded higher.

Today, the Japanese Industrial Production, which measures the outputs of the Japanese factories and mines was released by the Ministry of Economy, Trade and Industry. The report pointed out weakness, as the Japanese industrial production registered a decrease of 3.4% in February 2014, compared to the preceding month in which there was an increase of 3.7%. The yen was seen losing some ground after the release.

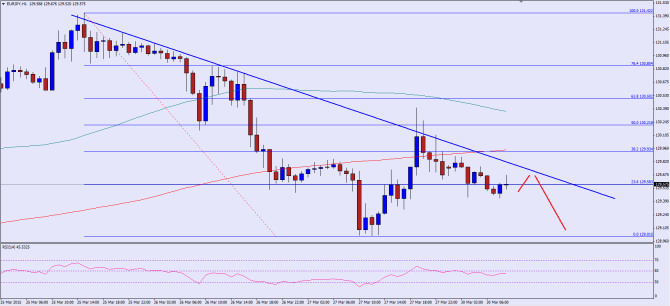

There is a monster bearish trend line formed on the hourly chart of the EURJPY pair, which stalled the upside every time the pair moved higher. The pair recently failed around the 50% fib retracement level of the last leg from the 131.42 high to 129.01 low. Moreover, the pair also failed around the 200 hour simple moving average, which acted as a barrier for the pair. The hourly RSI is also below the 50 level, which means the Euro sellers are here to stay and might cause more losses in the short term. There is a chance that the pair might make one more attempt to break the trend line, and it would be interesting to see whether it can do it or not.

On the downside, the most important support is around the last low of 129.00 where buyers might appear.

Overall, one might consider selling rallies in the EURJPY pair as long as it stays below the highlighted trend line.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In our latest podcast we interview David Stein on investment, QE and lots more

Subscribe to Market Movers on iTunes