The geopolitical risks still remain (Russia and Ukraine conflict) which is affecting the Euro negatively. In addition, the Euro bloc recovery is still fragile, with three of the largest economies (Italy, France, Germany) in the Euro bloc recording preliminary growths in the range of -0.2% to 0%. In addition, the Euro bloc achieved a final GDP q/q result of 0% showing signs that the recovery is losing momentum. Mario Draghi may need to resort to other measures such as QE (Quantitative Easing) to revive the recovery. QE will help reduce the value of the Euro further (good for exporters), stimulate growth and ease disinflationary pressures. Mario Draghi needs to stick to his pledge of ‘whatever it takes’ to assure markets that a recovery will continue.

The Fed is expected to continue tapering at this week’s meeting. There have been no major hiccups in the economy. Although, there could be a major hiccup with the heavily inflated US equity markets. Once the Fed starts tapering and raising interest rates, we could see a devastating damage to the US recovery due to the US equity markets. It will be interesting to see what will happen when tapering concludes in October.

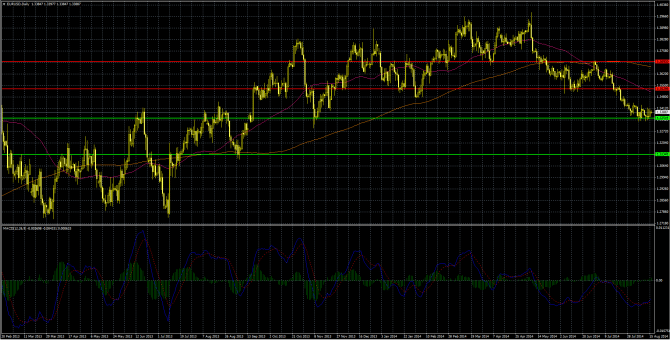

|

Support 2 (S2) |

Support 1 (S1) |

Current Price |

Resistance 1 (R1) |

Resistance 2 (R2) |

|

1.31340 |

1.33519 |

1.33887 |

1.35296 |

1.36930 |

The pair is has been in steep downtrend. We have identified R1 to be a weak ceiling for the pair, the pair has tested this level once as a support, prior to a break. The pair has tested this level once as a resistance level, the pair broke this level briefly then retracted. R2 is a strong ceiling for the pair, the pair has tested this level one and the pair has failed to break it. R2 is also supported by the 200-day MA (orange).

S1 is a strong floor for the pair, the pair has tested this level three times, and the pair has failed to break it. S2 is also a strong secondary floor for the pair, the pair has tested this level once and the pair has failed to break it.

Technicals: MACD (Moving Average Convergence Divergence) and MAs (Moving Averages)

- 200-day MA (orange) and 50-day MA (magenta) is downward sloping signalling a bearish stance for the pair. 200-day MA and 50-day MA will provide additional resistance to the pair.

- MACD is below zero and the red signal line is below the MACD, hence we may see a retracement before the downtrend continues.

In the short term, the pair is bearish. Italy still has some structural problems, which will affect the Euro negatively as it will take a long time for the progress to show in the data. In addition, if the ECB resort to QE then this will further devalue the Euro. Continuation of tapering should increase the value of the greenback. Although the outlook after the taper looks uncertain.

CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.

Guest post by Ajay Pankhania of Accendo Markets