The USD dollar has been trading higher against its rivals during the Asian trading hours. AUD, GBP and CAD are still the weakest while JPY is trying to find some support for the near-term. The larger picture of the markets remains unchanged but still very messy.

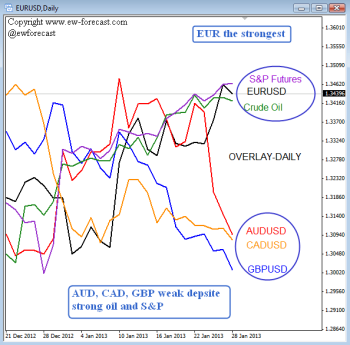

Below we have an overlay chart between some major FX currencies compared to S&P Futures and Crude Oil. We can see a strong negative correlation between FX pairs where only the EUR is moving higher in-line with risk-on assets, such oil and S&P.

Honestly, we do not like divergences too much, especially not between the Aussie and S&P which in fact could be signaling for a coming pull-back on stocks.

Overlay-Daily

Anyhow, traders need to trade what they see and not what they think, so at the moment looking for longs on EUR-crosses should be the best choice.

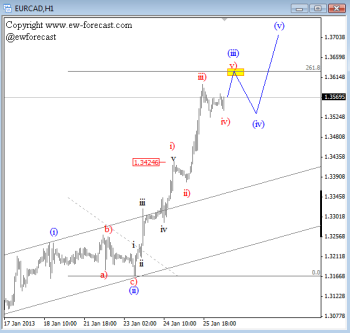

Below we are looking at EURCAD which is trading higher in wave (iii) that may slow down around 1.3630. Ideally we will see a fourth wave pull-back from there and back to 1.3500 which could be a long opportunity for short-term traders to catch wave (v) rally.

EURCAD 1h

Not a member yet?? Get more charts and forecasts with free access through 7-Day Trial Offer.

You can also follow us on twitter @ewforecast