Euro dollar continued its rally as it edged up yesterday (March 26th) by 0.67% following Bernanke’s speech on the U.S labor market in which he reignited the possibility of another quantitative easing plan. Despite his a bit gloomy speech, there is still little evidence to support the need of another stimulus plan as the fundamentals haven’t changed and the US continues improving. Today we’ll get another appearance from Bernanke, as well as the US confidence report.

Here’s an update on fundamentals and what’s going on in the markets.

EUR/USD Fundamentals

- 15:00 U.S Consumer Confidence

- 17:45 US Federal Reserve Chairman Ben Bernanke talks.

- 15:00 US FOMC member Dudley talks.

- 20:45 US FOMC member Duke talks.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Bernanke’s talk about labor market ignited talks about another stimulus plan: In Bernanke’s public speech he acknowledged the rapid improvement in the labor market, but he was also not sure if this rally is sustainable or will the unemployment rate start rising again.

Bernanke also stated that:

“Further significant improvements in the unemployment rate will likely require a more-rapid expansion of production and demand from consumers and businesses, a process that can be supported by continued accommodative policies,”

This means QE3 is still on the table even though Bernanke didn’t commit to anything; he just kept this option on the table without committing to it. This speech may have weakened the US dollar against the Euro.

- U.S long Term Treasuries Yields Edged Up: Following the recent speech of Bernanke the 30 year treasury yields edged up to 3.33; the 10 year yields also increased to 2.26 and thus have risen by 0.28 basis points since the beginning of March. Thus the gap between the 10-y and 30-y reached 107 basis points, which suggest less concern for inflation in the U.S (this gap (AKA yield curve) already reached this year 116 basis points).

- U.S Pending Home Sales Edged Down in February: The U.S. pending home sales index edged down by 0.5% in February 2012 but was still 9.2 percent above the February 2011 index, which stood back then at 88.4;

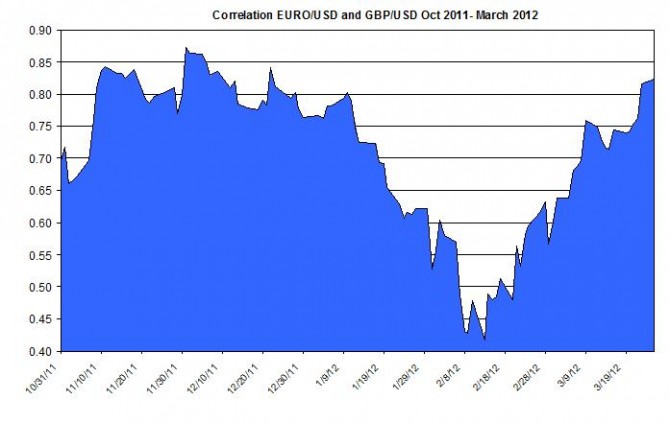

- The Rising correlation between Euro/USD and GBP/USD: In recent weeks there has been a rising relation between these two currencies pairs and currently their linear correlation stands on 0.82 (see chart below). This finding suggests the relation between the Euro and GBP has strengthened

.

- Draghi opposes Greece existing Euro Zone: In his recent speech, President of ECB Mario Draghi stated that he is against Greece leaving the Euro Zone because this move won’t help Greece. Draghi continues to warn about inflation, especially in case Greece will exit the EU. But he also stated if the inflation pressures will rise, ECB has tools to ward them off.