EUR-USD begins slipping out of range and is trading at the 1.07 handle.

The team at Goldman Sachs has already lowered forecasts, and now focuses on targets for the shorter term:

Here is their view, courtesy of eFXnews:

The recent revision higher of Euro area growth and inflation forecasts by both policy makers and private sector economists gives rise to a key question for the market: how should the EUR trade in a Euro area cyclical upswing?

In a recent note to clients, Goldman Sachs analyzes this question by comparing the ECB’s current policy mix with the experience of the USD during the post-crisis period of very easy Fed monetary policy. GS’ analysis gives us a template for how the EUR can trade during the current cyclical rebound.

The following are the key findings in GS’ analysis along with its recent EUR/USD forecasts:

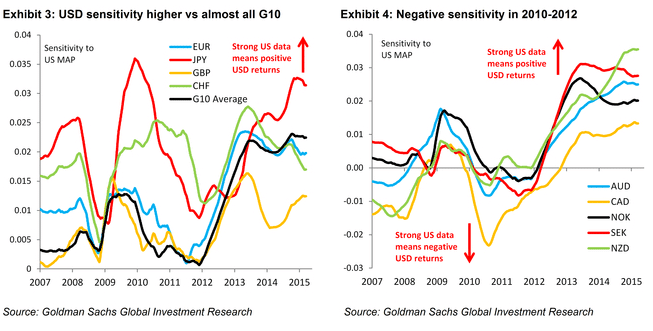

1- “The experience of the USD during periods of forward guidance and QE tells us that the EUR should not have a strong reaction to improvements in Euro area data. And given this insulation from the impact of better domestic data, the EUR can continue to weaken as the US normalises policy in response to US cyclical strength, and as QE-driven outflows from the Euro area continue,” GS argues.

2- “Until the improvement in Euro area cyclical data has a direct bearing on the policy path, it is reasonable to expect the data sensitivity of the EUR to remain low. Of course, it is possible that incoming data can eventually affect the policy path – in particular, incoming inflation data are key given the formulation of the ECB’s guidance on asset purchases discussed above. But we think the hurdle for incoming inflation data to alter the path of policy is high in the medium term given the recent upward revisions to the ECB’s growth and inflation forecasts,” GS adds.

“At the same time, like all USD crosses, EUR/$ is more sensitive to US data and so is more likely to respond to US surprises, either up or down. In all, continued downward pressure on EUR rates and a firm policy path from the ECB should keep the EUR weak even as Euro area data improve,” GS concludes.

EUR/USD forecasts:

In line with this view, GS maintains its EUR/USD forecasts at 1.02 in 3 months, 1.00 in 6 months, and 0.95 in 12 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.