Draghi delivered a massive QE program and sent the euro sinking across the board. Before we have too much time to rest, the central bank on the other side of the Atlantic makes its decision. What will Yellen do?

The team at BNP Paribas analyzes EUR/USD and reaches a conclusion:

Here is their view, courtesy of eFXnews:

The ECB’s quantitative easing programme announced Thursday 22 January exceeds high expectations, with the size of the programme even larger than the numbers leaked to the press on Wednesday, notes BNP Paribas.

“The ECB will buy EUR 60bn per month between March 2015 and September 2016, implying at least EUR 1.1trn in asset purchases. Moreover, ECB president Mario Draghi implied that the programme could be extended if needed to raise inflation back to target,” BNPP adds.

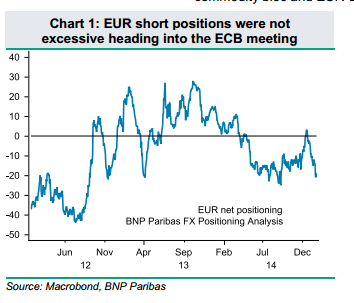

“The EUR has fallen significantly and against a broad range of currencies in response to the decision, consistent with the central bank having exceeded expectations. Our positioning indicator suggests markets were not overly positioned for EUR weakness going into the ECB meeting and have room to add to short positions,” BNPP argues.

looking ahead, BNPP thinks that he FOMC rate announcement next Wednesday may contain further hints towards an expected June rate hike.

“Our economists believe the market puts too little weight on the unemployment drop and too much weight on short-run moves in inflation. Accordingly, markets are pricing in less hiking than FOMC members feel is appropriate in the dot plots. There is potential for 2-year benchmark US yields to rise next week, thus supporting the USD further,” BNPP clarifies.

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.