What’s next for EUR/USD after the recent developments in Greece and Yellen’s upbeat testimony?

The team at Credit Suisse explains the uneasy calm:

Here is their view, courtesy of eFXnews:

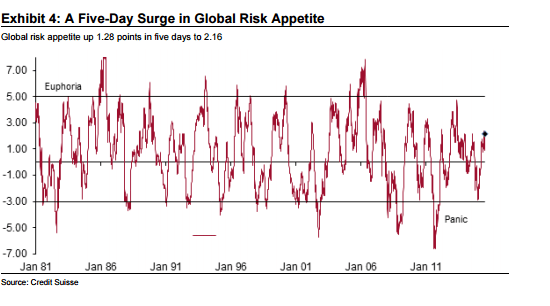

“A week ago, markets were braced for an imminent Greek exit from the euro area and the possibility of ongoing financial turbulence in China. Neither has materialized. Consequently, risk appetite has surged.

Fed Chair Yellen’s semi-annual testimony to Congress may not have lit the touchpaper to rates markets. But she was clear: if US economic data continue to run in their recent vein, the Fed will have begun tightening by the end of the year.

We agree with Fed Chair Yellen that the overall US recovery is strengthening, with the outlook for consumer spending underpinned by an expanding and tightening labor market and improving credit trends. Therefore, we continue to expect a September 17 rate hike, and, although they would never say it officially, we believe policymakers on the FOMC expect the same.

Our theme of monetary policy divergence is re-emerging. Markets should shift from trading tail risks around Greek headlines and deadlines to focusing on central bank policy action in coming months. That’ll mean economic data and central bank rhetoric move back to center stage.

We continue to forecast EURUSD at 1.05 in 3 months and 0.98 in 12 months. Diverging monetary policy between the ECB and the Fed is one of the main reasons for our bearish view.Yet we believe there are also other bearish drivers at play, which go beyond solely what the Fed does in coming months.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.