The EURUSD rally has taken some by surprise but some see it as the end of of the downtrend.

The team at Danske explains why and sets targets:

Here is their view, courtesy of eFXnews:

For EUR/USD, the ECB September meeting will be essential for a direction in the pair heading into the autumn. We expect Draghi to adopt a dovish tone on 3 September following the marked drop in oil prices and in inflation expectations lately. While this should not come as a major surprise we think the euro could come under pressure from verbal ECB intervention over the autumn to curb the drop in inflation expectations and thus speculation of a QE extension. Notably, the ECB will not want to see the euro strengthen – and definitely not if associated with oil heading lower still.

But, importantly, we do not expect new ECB measures to be announced and heading into 2016 the uptick in euro-zone inflation will become the dominant market theme, even with oil prices set to hover just above the USD/bb mark.

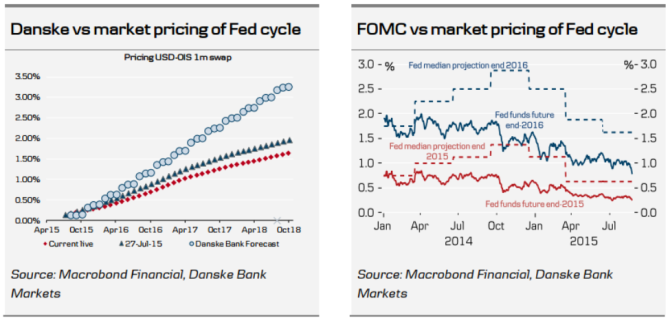

A first Fed hike in December and a re-pricing of the Fed following in Q1 next year should still lend support to USD but this will happen at a time when an ECB QE exit is moving closer.

As a result we see EUR/USD largely trendless on a 3-6M horizon with trading set to be concentrated in the 1.08-1.12 interval.

Further out, we maintain our long-standing view that EUR/USD will head higher towards levels warranted by medium- to long-term fundamentals.

We have now see EUR/USD at 1.13 in 1M, 1.10 in 3M, 1.10 in 6M, and 1.15 in 12M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.