EUR/USD is trading at new lows around 1.2255 last seen in 2012. The pair was hit hard by the superb jobs report in the US that continues boosting the greenback. In addition, fresh expressions of worry about euro-zone inflation as well as the situation in Greece weigh on the common currency. Is 1.20 at sight?

Here’s a quick update on technicals, fundamentals and sentiment moving the pair.

- Asian session: The pair initially held up against its peers before recahing a new low.

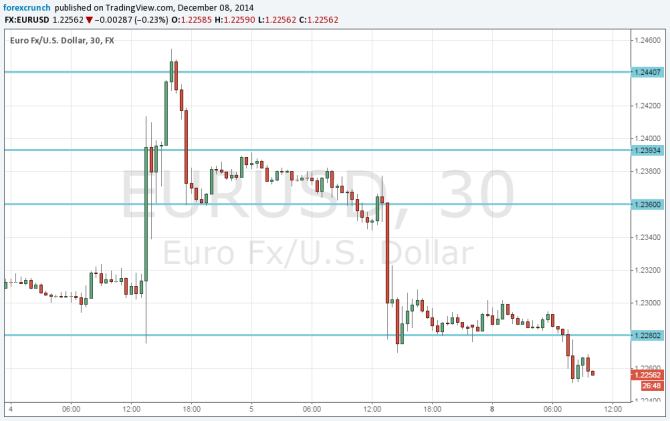

- Current range: 1.2250 to 1.2280

Further levels in both directions:

- Below: 1.2250, 1.2140, 1.2042 and 1.1876.

- Above: 1.2280, 1.260, 1.24, 1.2440 and 1.25

- 1.2250 is strong support. If it breaks, we could see a quick fall.

- 1.2360 is now strong resistance.

EUR/USD Fundamentals

- 7:00 German Industrial Production. Exp. +0.2%, actual +0.2%.

- 9:30 Euro-zone Sentix Investor Confidence. Exp. -9.9, actual -2.5 points.

- 15:00 US Labor Market Conditions Index.

* All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- NFP echoes: The US gained 321K jobs in November, in the best report in nearly three years. In addition, wages are finally on the rise, advancing by 0.4% m/m. While this accelerated advance may be a one off, it is already good news on its own for the greenback, which reached new highs against a wide variety of currencies. We have a reminder of the US labor market conditions today, as well as the Fed favorite JOLTS number tomorrow.

- Deflation worries: ECB member Ewald Nowotny expressed a lot of concern about the danger of prices falling even further in the euro-zone and stated there is a “massive weakening” in the euro-zone. Nowotny is not a pure dove, and if he’s worried, the chances of QE are growing. The key event this week is the TLTRO on Thursday.

- Greece is back: Time is running out for the small nation that was the epicenter of the euro debt crisis. There is a struggle between the EU/ECB/IMF troika and the country regarding new measures, and an open debate if it needs a third bailout program. In the background, we have a delicate political situation there. This is one of the key points of contention in the Eurogroup talks. For more: Greece could creep back to the headlines on political worries, primary surplus

- Draghi did not deliver: Contrary to his sense of urgency in previous statements, the ECB president did not announce any imminent QE but rather offered a “wait and see” mode for potential action in “early 2015”. It seems that the Germans pushed back and that there was a lot of disagreement. This triggered a big EUR/USD rally. However, the ECB did significantly cut its growth and inflation forecasts that were made before the recent sharp drop in oil prices. In addition, it is working on QE scenarios. Here are 5 reasons why this EUR/USD jump could be a sell opportunity.

In our latest podcast, we preview December’s big events, talk about the importance of jobless claims, the crash in oil prices and GOFO going negative: