There is a lot of noise in day to day trading in currencies. So what about the longer term?

The team at SocGen see both euro pairs lower in the longer term.

Here is their view, courtesy of eFXnews:

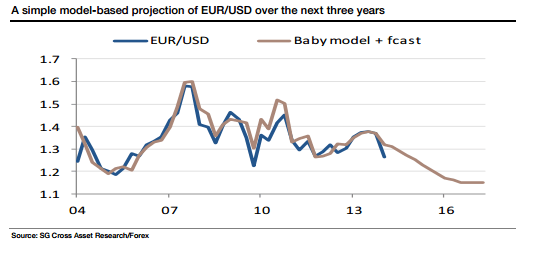

“We expect EUR/USD to reach 1.15 over the next three years, based on an assumption that the 2-year US/European interest rate differential widens to around 2% from its current 44bp, and both peripheral bond spreads and global risk sentiment stabilise somewhat from current levels. The eventual success of Abenomics and more moderate oil prices suggest EUR/JPY is heading for 115.

…Getting to EUR/JPY 115 through a combination of EUR/USD and USD/JPY forecasts is hard: Taking an upbeat (i.e. consensus) view of the global economy, the most plausible scenario is that USD/JPY gets stuck at 110 and EUR/USD falls to 1.05, while a serious re-emergence of market stress would see the latter rate reached more easily, with USD/JPY falling back to 100-105. But either way, from here on, and after the big adjustment we have already seen in USD/JPY, EUR/USD has more downside than USD/JPY has upside, unless the wheels come off the Japanese economy and Abenomics.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.