Euro dollar is ticking up above minor resistance and in a narrow range. All eyes are now on the US Non-Farm Payrolls, which hold high expectations but could disappoint. A deal in Greece is still awaited but some optimists are already moving to the pessimists camp. How will the pair end this tense week?

Here’s an update on technicals, fundamentals and what’s going on in the markets.

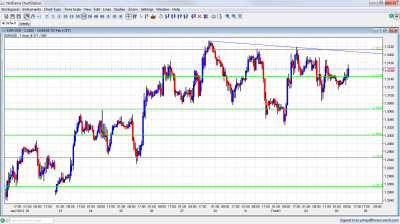

EUR/USD Technicals

- Asian session: A quiet session saw the pair trade under the 1.3145 line. A small move upwards began in the European session.

- Current range: 1.3145 to 1.3212.

- Further levels in both directions: Below: 1.3145, 1.3060, 1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623

- Above: 1.3212, 1.3280, 1.3333 and 1.3450.

- Note the downtrend resistance line which has been respected so far.

- Serious support is only at 1.2945. The round number of 1.30 isn’t strong.

- 1.3212 proved to be a strong cap.

Euro/Dollar tense before NFP- click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 Euro-zone Final Services PMI. Exp. 50.5. Actual 50.4 points.

- 10:00 Euro-zone Retail Sales. Exp. +0.4%. Actual -0.4%.

- 13:30 US Non-Farm Payrolls. Exp. 150K. Preview.

- 13:30 US Unemployment Rate. Exp. 8.5%.

- 13:30 US Average Hourly Earnings. Exp. +0.2%.

- 14:00 US ISM Non-Manufacturing PMI. Exp. 53.1 points. This figure usually serves as a great indicator to the NFP, but it is released late now.

- 14:00 US Factory Orders. Exp. +1.5%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Government could weigh on NFP: The expiration of tax incentives and government layoffs could blow the current hopes for 150K to 170K job gains, and raise the chances of QE. Only a very big job gain could counter Bernanke’s weight on the US dollar. See the NFP preview.

- Bernanke doesn’t mention QE, but remains soft: In his testimony, Bernanke didn’t mention a third round of QE, but he was quite soft on the economy, and worried about unemployment. The FOMC Statement contained one significant change: the low rates are now likely to remain until late 2014, instead of mid 2013 stated earlier. Together with a hint by Bernanke that QE3 is still open, the dollar fell and the pressure on the greenback will remain in weeks to come.

- Greece still stuck – hope fading: Jean-Claude Juncker, which said that when things get serious, it’s OK to lie, admitted that the situation is tough, but didn’t offer good news. Costa, from the ECB, also issued stark warnings. Negotiations are stuck between Greece and the troika. The idea to take over Greece’s sovereign budget powers is off the table, but demands for cutting the minimum wage and other demands are putting a lot of pressure on the Greek government. Also the demand for a commitment to move forward with austerity regardless to election results is extreme. It seems that the demands are meant to be rejected and talks are meant to collapse and blame Greece. It’s important to note that German Chancellor Angela Merkel has doubts if Greece can avoid a default.

- ECB Pressured to take a haircut: This seems to be the sticking point, after the Private Sector Involvement has been mostly agreed upon. More and more speakers call for the ECB to take a hit on Greek bonds, despite the “no bailout” clause in the EU Treaty. The pressure comes from the banks (naturally) and also from the IMF. Note that ECB president Draghi didn’t categorically reject this. If Greece defaults, the ECB will have a 100% involuntary haircut.

- Portugal deteriorates: Portuguese yields continue rising together with CDS, and point to a high chance of default. The chances of a default there are rising, especially if a PSI deal is signed in Greece and especially if also the ECB takes a hit.

- OK Numbers from the US: The manufacturing PMI was higher, with a good score in the employment component. The bigger sector, services, will release its numbers only after the NFP. ADP’s private sector report was a bit below expectations, but still pointed to growth in jobs. The jobless claims provided hope for a possible drop in the unemployment rate..