Euro dollar broke another minor resistance line and reached new 2012 highs as Greek leaders managed to agree almost on everything, in the hide of the night. The focus now moves to the ECB. Mario Draghi is expected to leave rates unchanged and will be requested to provide answers on the contribution of the central bank to the Greek bailout. In addition, we will get a fresh job figure from the US, following the astounding NFP. Busy day.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

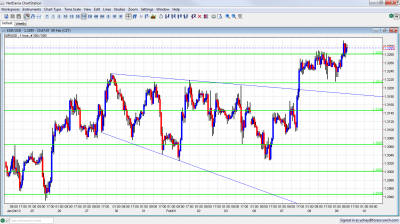

EUR/USD Technicals

- Asian session: A very active session in light of the Greek negotiations saw a break above 1.3280.

- Current range: 1.3280 to 1.3333.

- Further levels in both directions: Below: 1.3280, 1.3212, 1.3145, 1.3060, 1.30, 1.2945 and 1.2873.

- Above: 1.3333, 1.3450, 1.3550 and 1.3650.

- After 1.3280 was cleared, 1.3450 is more serious.

- 1.3212 turns into support after being broken.

Euro/Dollar on high ground- click on the graph to enlarge.

EUR/USD Fundamentals

- 12:45 Euro-zone rate decision. Rate expected to remain at 1%. See 5 reasons why.

- 13:30 ECB Press Conference. Draghi will be questioned about the contribution to Greek aid.

- 13:30 US Unemployment Claims. Exp. 369K.

- 15:00 US Wholesale Inventories. Exp. +0.4%.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Huge Progress in Athens: Greek politicians worked all night and agreed to harsh cuts: a 22% in the minimum wage is the strongest concession. They couldn’t agree on a pension issue, and this leaves a hole of 300 million. The troika gave Greece two long weeks to find another source for this. The breakthrough is the main reason for the euro’s move higher. This will most probably secure the second bailout. Together with the grace period, March 27th is the final deadline. For a potential default of Greece (Grefault), the Greek PM asked for a report.

- No rate cut expected: Given the growing signs of recession and the ongoing debt crisis, pressure mounts on the ECB to cut the rates to 0.75%. Nevertheless, there are 5 reasons why Draghi will likely wait. In any case, the press conference will be interesting to see, especially as Draghi will likely be grilled on the contribution to the bailout.

- ECB closer to a haircut: The pressure for Official Sector Involvement probably succeeded. A new report in the WSJ says that the ECB will somehow unload the Greek debt to the EFSF, keep its balance sheet balanced, and perhaps that the EFSF will take a hit. Details are unclear, but progress has been made here. The Germans earlier insisted on keeping the ECB out of the barber shop. Note that ECB president Draghi didn’t categorically reject this. If Greece defaults, the ECB will have a 100% involuntary haircut.

- Portugal awaits Greece: Portuguese yields remain on high ground. The path chosen for Greece will likely be followed by the small Iberian country in the infamous “contagion” effect that is feared.

- Bernanke dismisses job growth: The drop of the unemployment rate to 8.3% and the gain of 243K jobs in January gave a lot of hope for the US. Nevertheless, in a testimony in Washington, Ben Bernanke dismissed the positive figure. He mentioned the employment-to-population ratio and said that 8.3% understates the real state of unemployment, which he sees as quite gloomy. So, QE3 still has a chance in March, even if quite low. Today we’ll see if weekly claims continue falling. The 4 week moving average will certainly drop, as the last number in the series was especially high.