EUR/USD did not have a merry Christmas, eventually closing on lower ground. Can it make an attempt on 1.20, or will that wait for the time trading volume gets back to normal? In the week around the turn of the year, we have some PMIs and the last round of the Greek presidential elections. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Not a lot of data was released around Christmas, but the figures that did come out were not encouraging: a drop of 0.8% in German import prices and stagnating Italian retail sales won over a better than expected rise in French consumer spending. In the US, the final read of GDP for Q3 was excellent, with a rate of 5% annualized growth. However, more recent data such as durable goods orders and housing data was somewhat mediocre.

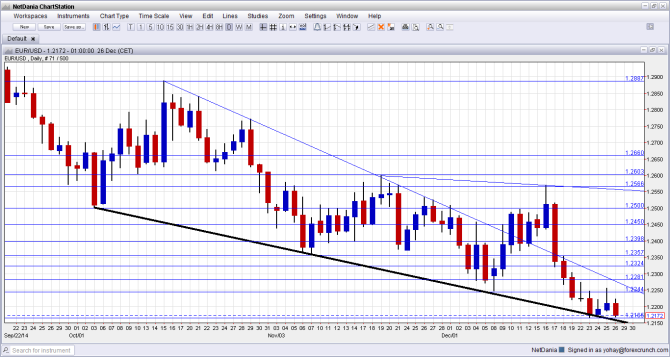

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Greek presidential elections: Monday. The third and final round of the presidential elections could complicate things for the euro-zone. The government needs 180 out of 300 votes in order to nominate the representative role. While the role itself is not important, a failure automatically triggers general elections, in which the anti-austerity and pro-restructuring SYRIZA party is set to win. Greece is not in the limelight but a return of the country’s debt crisis could certainly raise uncertainty. The government got 168 votes for the sole candidate Stavros Dimas in the second round, and many estimate that it could convince some more members to vote for him and not risk losing their parliamentary seat.

- Spanish Flash CPI: Tuesday, 8:00. Inflation data from the euro-zone’s fourth largest economy isn’t usually that important, but this time it’s different: Spain releases the figures for December ahead of other countries and the numbers will already incorporate the sharp fall in oil prices. After an annual decline of 0.4% in prices, a bigger fall of 0.7% y/y is expected.

- M3 Money Supply: Tuesday, 9:00. The ECB has reported an acceleration in money growth in recent months. After the amount of money in circulation grew by 2.5% in October, growth is expected to edge up to 2.6%.

- Private Loans: Tuesday, 9:00. Also private loans are moving in the right direction, partly due to the easing measures of the central bank. However, year over year, loans are still contracting. After a slide of 1.1% in October, a slower slip of 0.9% is on the cards now.

- Spanish Unemployment Change: Friday, 8:00. While unemployment is very seasonal in Spain, this monthly gauge provides a picture of a country which has a huge unemployment rate, but seems to move in the right direction. After a drop of 14.7K in November, a bigger drop of 72K is expected in the number of the jobless.

- Manufacturing PMIs: Friday: Spain at 8:15, Italy at 8:45 and the final euro-zone number at 9:00. According to Markit, Spain’s manufacturing sector grew in November, with a score of 54.7, above the 50 point mark separating growth and contraction. A score of 54.9 is expected now Italy, the zone’s third largest economy, experiences a contraction in this sector with 49 points. A rise to 49.6 is predicted now. For the whole euro-zone, a confirmation of the initial December data at a break-even figure of 50 points is expected. Note that Germany and France release their final numbers just before the final euro-zone publication.

Markets are set to grind to a halt on December 31st, stay practically close on January 1st and suffer from thin liquidity on January 2nd.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a move up to 1.2280 (mentioned last week). However, after failing to break higher the pair tumbled down to 1.2165, and this became support. Further fluctuations saw the pair failing to settle above resistance and it eventually closed near the lows.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

1.27 is a round number and also worked as resistance to a recovery attempt. This is followed by 1.2660 – which marks the beginning of long term uptrend support.

Below, 1.2570 is the initial low seen in October and now a line of resistance. The next line is critical: of 1.25, which is USD/EUR at 0.80. The pair had various battles around this line, from the topside in October and from the downside in December.

1.2450 is resistance after the pair reached this line in a recovery attempt during December. The round number of 1.24 is now a pivotal line in range. It is followed by 1.2360, which worked as support more than once, including in November 2014. It was a double bottom at one point.

1.2280 joins the chart after it provided support to the pair in December, but it isn’t a strong line. 1.2245 served as support several times in that summer, and 1.2170 was the “shoulder” in the inverse H&S pattern around the same time. It was also the low point in December 2014. The last line in the previous cycle is the 2012 low of 1.2040.

Even lower, the post crisis low of 1.1875 should be watched, as well as 1.17, which was the launch value of the pair in 1999.

Uptrend support working well

As the thick black line shows, the pair is now trading above a downtrend support level that accompanies the pair since early October. It worked well in November and in December during several occasions.

I am bearish on EUR/USD

QE in the euro-zone seems closer and closer. This weighs heavily on the euro. In the US, there seems to be a gap between the excellent second and third quarters and some kind of slower growth in Q4. Nevertheless, the momentum of the strong dollar is likely to continue in the last days of the year, in a “Santa Rally” of sorts. The general trend remains down, even up to 1.05, but we could see some kind of corrections as doubts creep regrading the US recovery. This will probably wait for the next week and not now.

In our latest podcast, we run down all aspects of the Fed decision, discuss the running down of oil, the run down Russian ruble and the weak currency down under:

Subscribe to our podcast on iTunes.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.