EUR/USD was heavily influenced by every headline related to Greece and the positive finish to the week provides hope. The last week of February features another TLTRO auction as well as inflation and confidence numbers, with the highlights coming from Draghi’s speeches. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Negotiations saw their ups and also their downs. Conflicting headlines created a lot of volatility.Eventually, a 4 month extension was agreed upon. However, there are bumps along the way, as soon as this Monday. Will we get a break from these headlines? Elsewhere, the first ever ECB minutes showed that QE was “inevitable”. German business confidence improved, but not as much as expected. PMIs showed a growing divide between struggling manufacturing and stronger services. In the US, numbers were mixed. What’s next for the pair?

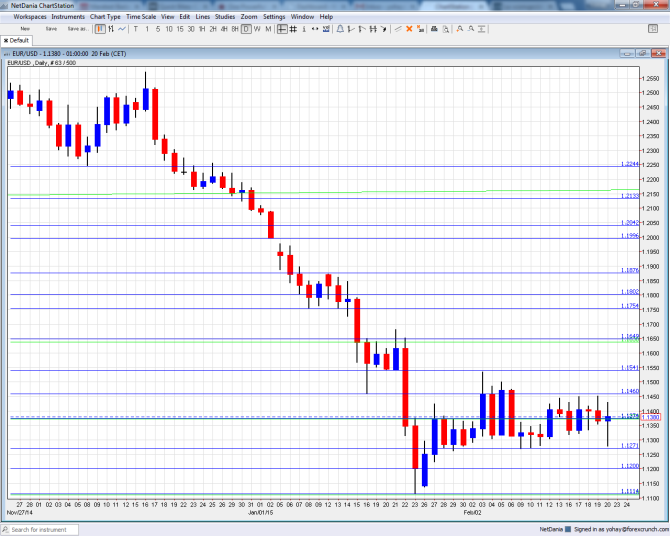

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 9:00. Germany’s no. 1 Think tank reported a rise of confidence in January to 106.7, continuing the positive streak. ZEW already reported a rise for February, and IFO is expected to follow suit in its 7,000 strong survey, with a score of 107.4 points.

- Greek reform list submission: Monday, late. Greece is working on a general proposal for reforms during the weekend. They have to submit it until Monday, end of day, and receive an approval for it by their European partners. There could still be bumps here.

- German Final GDP: Tuesday, 7:00. The initial read for Q4 showed a strong growth rate of 0.7% q/q for Europe’s largest economy. This will likely be confirmed in the final publication.

- Final CPI (January): Tuesday, 10:00. According to the initial numbers, deflation has deepened in the euro-zone, with headlines inflation falling 0.6% y/y. Also core inflation was far from encouraging, with 0.6%. A confirmation is on the cards now, but revisions are not uncommon.

- Mario Draghi talks: Tuesday, 14:00 and Wednesday at 16:30 The president of the ECB has two public appearances. The first is in a ceremony for the revelation of a new €20 banknote and the second one is more important: an official testimony in the European Parliament. Draghi has a lot on his plate: regarding Greece, the decision not to accept Greek government bonds as collateral but to extend the ELA, the talk about capital control and contingency plans for a Grexit. In addition, he will likely refer to and be asked about the QE decision and of course the situation of the European economies. Will he send the euro down like he recently did in recent months?

- Belgian NBB Business Climate: Tuesday, 14:00. The country in the heart of the European Union has showed deteriorating confidence in January: -8.8 points, which reflects pessimism. Another tick down within negative territory is on the cards now.

- GfK German Consumer Climate: Thursday, 7:00. This survey of around 2000 consumers has been advancing in recent months. Germans enjoy a better economic environment, driven in part by weaker oil prices. After 9.3 in January, a similar figure is likely now: -8.4 points.

- German Unemployment Change: Thursday, 8:55. In the past four months, unemployment has been falling in Germany. However, it slowed down to a drop of 9K in December. Another drop is on the cards now, of 10K. The unemployment rate is expected to stay at 6.5%.

- M3 Money Supply: Thursday, 9:00. The supply of money has accelerated in recent months thanks to the ECB’s action, and has risen by 3.6% y/y in December. A rise is estimated now to 3.8%.

- Private Loans: Thursday, 9:00. Lending has squeezed for long months, but at least the pace has been falling. After a y/y squeeze of 0.5% in December, a minor drop is expected for January: -0.3%.

- Targeted LTRO: Thursday, 10:15. This is the third such operation by the ECB. The central bank lends money to the banks on the condition that they lend it to the real economy. The first operation in September resulted in 82.6 billion euros and the second one in December reached 129.8 billion. The figures were below market expectations and contributed to the introduction of QE. A big auction now could slow the pace of QE, while a small one would make it more necessary.

- German inflation data (February): Friday, all German read at 13:00. Germany also entered deflation with prices falling 0.4% y/y and 1.1% m/m in January. The preliminary numbers for February might show a gain m/m, +0.6% is expected as oil stabilized, but will probably show a y/y deterioration.

- German Import Prices: Friday, 7:00. Prices of imported goods provide an insight into inflation. In December, they fell more than expected: 1.7% m/m and 2.2% y/y. Negative numbers are expected for January 2015 as well: -0.8%.

- French Consumer Spending: Friday, 7:45. Europe’s second largest economy has enjoyed a remarkable jump of 1.% in prices for the month of December 2014. This could be thanks to Christmas shopping, but it wasn’t really expected by economists. A drop is likely now: -0.3%.

- Spanish and Italian Flash CPI: Friday, 8:00 and 10:00 respectively. Spain is experiencing strong deflation, and for long months. After a drop of 1.3% y/y in January, a drop of 1.5% y/y is predicted now. Italy saw prices fall 0.4% m/m and a small 0.2% m/m gain is on the cards now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar kicked off the week with a downwards move to support at 1.1313 (mentioned last week) before shooting back up and enduring see-saw trading. This erratic range trading resulted in a close at 1.1380, very close to last week’s.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

The post crisis low of 1.1867, should be watched. 1.1750 was a low point the pair reached in a breakdown in early January 2015. The round number of 1.17 was the launch value of the pair in 1999 and has a symbolic meaning.

Below, we have the post Swiss bounce of 1.1650 which worked as resistance. Lower, 1.1540 provided support in mid January.

Below the round number of 1.15 we have the pre-QE low of 1.1460 that could work as resistance.

1.1373 was the low line seen in November 2003 and proved to work as resistance and support lately. Below the initial low point of 1.1313 we have 1.1270, which provided support twice in February 2015.

The round number of 1.12 is now the pivotal line in the range. It is followed by the fresh low of 1.1113 which is nearly 0.90 on USD/EUR.

The next line is the round 1.10. It is followed by 1.0760, which was the low point in both July and August 2003.

Below this point we have the round numbers of 1.05 and 1 – EUR/USD parity, which is already eyed by some analysts.

I turn bearish on EUR/USD

Assuming that the Greek crisis is over for now (and that’s somewhat optimistic), the focus could return to the more important drivers of the pair: monetary policy divergence. Draghi’s speech and inflation numbers could remind us of the downside pressure on the common currency, and Yellen could remind us that the Fed is en-route to tighten, even if this might come at a later dater due to underwhelming data.

In this week’s podcast, we cover Questions for traders, State of Fed, Greek crisis, oil, gold and GBP

Subscribe to our iTunes page

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.