EUR/USD had an exciting week in which it staged a nice recovery, but eventually lost most of its gains. GDP figures stand out in this week’s trading and Greece will not be too far from the headlines. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Greece refused to move away from the headlines. Greece’s finance minister is touring European capitals. While smiles are seen on the outside, the decision of the ECB to stop accepting Greek bonds as collateral hurt the country and the euro: some say the chances of a Grexit are higher than in 2012. European figures were OK with improving PMIs. In the US, a streak of bad figures triggered a temporary yet sharp USD sell off. Factory orders were the straw that broke the camel’s back and. However, things changed with a grand finale: a superb NFP report showed 257K jobs gained, upwards revisions and big bounce in wages.

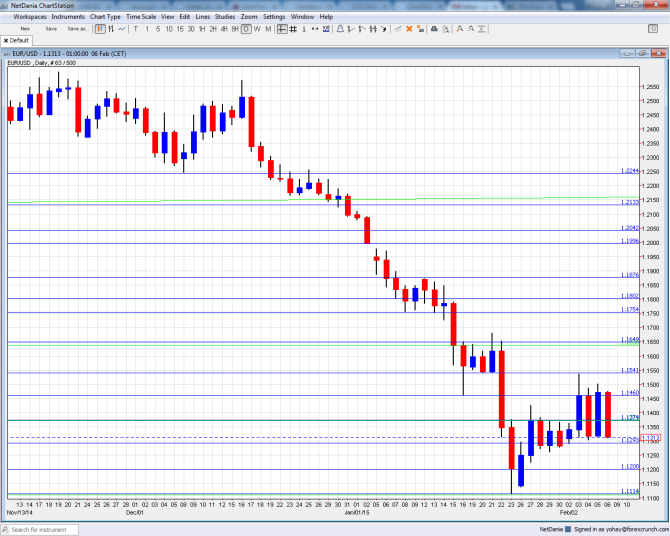

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Trade Balance: Monday, 7:00. Germany’s export machine results in a positive trade balance, and this keeps the euro bid. After a surplus of 17.7 billion in November, a rise to 18.2 billion is predicted for December.

- Sentix Investor Confidence: Monday, 9:30. This wide survey of 2800 analysts and investors turned positive in January after 4 negative months. The optimism is expected to increase with a rise from 0.9 to 3.4 points in February.

- French Industrial Production: Tuesday, 7:45. Europe’s second largest economy saw a drop of 0.3% in industrial output during November. The pendulum is expected to swing to the other direction with a rise of 0.3% this time.

- EU meeting on Greece: Wednesday. The EU has called an extraordinary meeting on February 11th and the only topic on the agenda is Greece. This follows a European tour of Greek FM Yanis Varoufakis, that ended in an acrimonious tone with his German counterpart. On the same day, the waiver of Greek bonds expires at the ECB. Any headlines coming from the meeting are set to rock the euro, especially those from the German representatives.

- German Final CPI: Thursday, 7:00. Germany is also in deflation according tot he initial data for January. The m/m fall of 1% will likely be confirmed now. This deflation justifies the ECB’s QE that Germany is opposed to.

- Industrial Production: Thursday, 10:00. While the data is published after French and German data is out, this number still has an impact. A gain of 0.3% is likely in December after a similar rise of 0.2% in November.

- Preliminary GDP: Friday: France at 6:30, Germany at 7:00, Italy at 9:00 and the whole euro-zone at 10:00. These are the preliminary numbers for Q4. The French economy grew by 0.3% in Q3 after a revised down contraction of 0.1% in Q2. These not-very impressing numbers are expected to continue with a growth rate of only 0.1% in the last quarter of the year. Germany isn’t doing much better: its economy also escaped recession, and only just: a growth rate of 0.1% was recorded in Q3 after a squeeze of 0.2% beforehand. A stronger growth rate of 0.3% is on the cards now. The third largest economy in the euro-area, Italy, is suffering a recession lasting 3 quarters. After a drop of 0.1% in Q3, a flat read is on the cards now. Spain stood out by reporting strong growth. The numbers from the fourth largest economy were already published. For the whole of the euro-zone a growth rate of 0.2% is estimated for the last quarter of 2014, just like Q3.

- French Non-Farm Payrolls: Friday, 7:45. While the focus si on the GDP figures, France is expected to report a drop of 0.1% in jobs for Q4, slower than 0.2% seen in Q2.

- Trade Balance: Friday, 10:00. Thanks to Germany, but not only this country, the zone enjoys a surplus. after a positive 20 billion in November, we could see a wider surplus of 21.3 billion now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started off the week above the 1.1290 line (mentioned last week) and eventually shot higher all the way to 1.1540. From there the pair fell back down and returned to the previous range.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

The post crisis low of 1.1867, should be watched. 1.1750 was a low point the pair reached in a breakdown in early January 2015. The round number of 1.17 was the launch value of the pair in 1999 and has a symbolic meaning.

Below, we have the post Swiss bounce of 1.1650 which worked as resistance. Lower, 1.1540 provided support in mid January.

Below the round number of 1.15 we have the pre-QE low of 1.1460 that could work as resistance.

1.1373 was the low line seen in November 2003 and proved to work as resistance lately. Below the initial low point of 1.1313 we have 1.1290 which was the post collapse recovery limit.

The round number of 1.12 is now the pivotal line in the range. It is followed by the fresh low of 1.1113 which is nearly 0.90 on USD/EUR.

The next line is the round 1.10. It is followed by 1.0760, which was the low point in both July and August 2003.

Below this point we have the round numbers of 1.05 and 1 – EUR/USD parity, which is already eyed by some analysts.

I turn from neutral to bearish on EUR/USD

The Greek crisis refuses to leave the headlines and overshadows some positive euro-zone data. While the baseline scenario is that Greece will stay in the euro-zone, the February 28th deadline is too far. Things will probably get worse before they get better, and this could weigh on the euro. In the US, data has been unconvincing, until it comes to what matters most: jobs. The excellent NFP report, with its positive revisions and bounce in wages removes some of the doubts about the upcoming rate hike.

In our latest podcast, we do an Aussie Analysis, Greek Grindings and Oil Optimism.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.