EUR/USD took a deep dive in the week that put us into 2015. The pair is trading at the lowest levels since 2010. Are further falls awaiting us or is a big correction awaiting? Markets are returning to strong form in the first full week of 2015. CPI is the big release in a busy week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

In the last week of 2014, news broke that Greece is headed to general elections. While this was expected by markets, it could certainly continue weighing on the euro during January. We also heard some German opposition to QE, but given the early signs of December’s deflation coming from Spain, can they really stop it? Probably not, if we listen to Draghi. Also the change in flows is a euro negative. Looking to the US, we had some mediocre numbers, but the general picture is still of solid growth.

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German CPI: Monday, states release data during the European morning, all-German release at 13:00. German consumer prices remained flat in November m/m amid sliding oil prices and a struggling economy. With the fall in oil prices being fulling felt in December, a significant drop in prices is expected. This is a key input for the all-European figure later on. A m/m rise of 0.2% is expected, while year over year, a very weak rise of 0.3% is on the cards.

- Spanish Unemployment Change: Monday, 8:00 (postponed from the previous week). While unemployment is very seasonal in Spain, this monthly gauge provides a picture of a country which has a huge unemployment rate, but seems to move in the right direction. After a drop of 14.7K in November, a bigger drop of 72K is expected in the number of the jobless.

- Sentix Investor Confidence: Monday, 9:30. This wide survey of investors has improved to -2.5 points in December. While the number was negative, reflecting pessimism, it was the best since August when it was positive. A move to -0.9 points is expected now.

- Services PMIs: Tuesday: Spain at 8:15, Italy at 8:45 and final euro-zone data at 9:00. The services sector is doing better than manufacturing in most countries. Spain had a figure of 52.7 in November, above the 50 point mark separating growth from contraction and 52.9 is expected now. Italy had 51.8 and a slide to 51.4 is predicted now. The euro-zone 51.9 points in the preliminary number for December, which is expected to be confirmed now.

- German Unemployment Change: Wednesday, 8:55. Europe’s largest economy enjoyed two consecutive months of drops in unemployment, beating expectations. After the fall of 14K in October, a smaller drop is on the cards for December: 6K jobless.

- Retail PMI: Wednesday, 9:10. This PMI by Markit measures the retail sector, which is not too optimistic. A score of 48.9 was seen in November, above previous months but still in contraction territory. Can the drop in oil prices push purchasing managers in this sector to growth ground?

- German Retail Sales: Thursday, 7:00. The volume of sales is quite volatile in Germany: a rise of 1.9% in October followed a drop of 2.8% in September. A small rise is likely now: +0.2%.

- Inflation data: Wednesday, 10:00. This is critical input for the ECB meeting on January 22nd. Inflation has reached rock bottom levels in November: 0.3% in headline CPI, which is the ECB’s mandate, and 0.7% in core prices. These numbers were already seen in this cycle but they are the lowest. With the fall in oil prices seen mostly in December, there is no doubt that we will see a lower headline number now. Expectations stand at 0% y/y. The big question is: will we see a an annual drop in prices? Also the core number is important: if prices excluding oil and other volatile components remain stable, it could give the central bank something to cling to. However, a downgrade is expected here as well, to 0.6%.

- Unemployment Rate: Wednesday, 10:00. One of the reasons for low inflation is the lack of demand, and this has a lot to do with high unemployment: 11.5% is the level seen in the euro-zone for the past 5 months. The same level is predicted for November.

- German Factory Orders: Thursday, 7:00. The German locomotive saw two straight months of rises in orders at the factory level, following a big drop beforehand. After the rise of 2.5% in October, a small drop is likely for November: -0.6%.

- Retail Sales: Thursday, 10:00. While the euro-zone number is released after the German publication, it is still meaningful and moves markets.A poor growth rate of 0.4% was seen in October, following a drop of 1.2% in September. Another small growth figure is likely now: +0.3%.

- PPI: Thursday, 10:00. Producer prices are pressured to the downside, and October’s number was especially weak with a drop of 0.4% m/m. Another drop is on the cards now: -0.2%.

- German Industrial Production: Friday, 7:00. Following the factory orders release, Germany releases industrial output. After a rise of 0.2% in October, a similar print is likely now: a gain of 0.4%.

- German Trade Balance: Friday, 7:00. One of the things that kept the euro bid for a long time is the positive trade balance, driven in most by Germany. The trade surplus of this country crossed the 20 billion dollar mark and hit 20.6 billion in October. A slightly narrower surplus is estimated now: 19.4 billion.

- French Industrial Production: Friday, 7:45. The zone’s second largest economy saw output from its industry fall by 0.8% in October, worse than expected. A bounce is expected now with +0.4%.

- French Trade Balance: Friday, 7:45. Contrary to Germany, France suffers from a trade deficit which stood on 4.6 billion in October. A marginally narrower deficit is on the cards now: 4.5 billion.

* All times are GMT

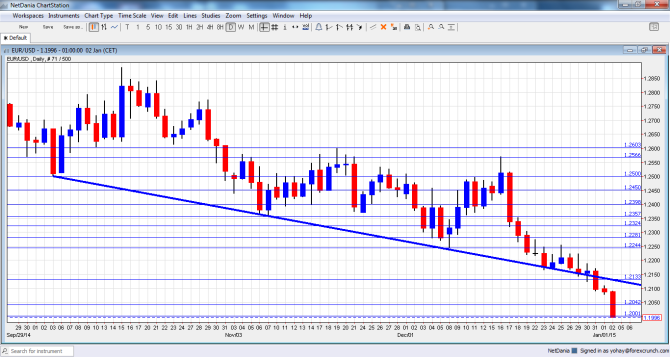

EUR/USD Technical Analysis

Euro/dollar started off the week with a test of the lows at 1.2165 (mentioned last week) from where we had a bounce, but the pair’s fate changed around the change of the year: it dropped to new lows and eventually broke the 2012 low of 1.2042, closing the week just under the critical 1.20 level.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

We start from lower ground now. 1.2450 is resistance after the pair reached this line in a recovery attempt during December. The round number of 1.24 is now a pivotal line in range. It is followed by 1.2360, which worked as support more than once, including in November 2014. It was a double bottom at one point.

1.2280 provided support to the pair in December, but it isn’t a strong line. 1.2245 served as support several times in that summer, and 1.2170 was the “shoulder” in the inverse H&S pattern around the same time. It was also the low point in December 2014. The last line in the previous cycle is the 2012 low of 1.2040.

The very round number of 1.20 is still a battle ground, but the last one before much lower levels.

Even lower, the post crisis low of 1.1875 should be watched, as well as 1.17, which was the launch value of the pair in 1999.

If we take an even deeper dive, 1.1620 provides some support before the round number of 1.15.

Uptrend support broken

The line that provided support to the pair during October, November and December several times, is now broken after the last crash.

I am bearish on EUR/USD

Everything is playing against the euro and momentum seems strong: the seriousness in which Draghi wants QE is driven by weak inflation. We have already seen a big drop in Spain and now we can expect the all-European numbers to echo. A drop to outright deflation, even temporary, could exacerbate the falls. While a weaker euro, weaker oil prices and monetary stimulus are all set to help the euro-zone eventually, there is probably more room on the downside for quite some time.

On the other side of the Atlantic, the US seems to have slowed down in Q4, but it still enjoys strong growth in the economy and jobs, a positive inflation rate and a central bank that is set to hike this year. This busy week could see yet another fall in EUR/USD.

In this week’s podcast, we offer a preview for 2015: the Fed hike, EZ QE, slippery oil, UK politics, Big in Japan, AUD down under, Loonie blues and Gold

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.