EUR/USD lost ground for another week and reached levels last seen in November 2013. Will it continue lower? Inflation numbers stand out among the wide list of releases due. Here is an outlook on the highlights of this week and an updated technical analysis for EUR/USD.

Eurozone PMIs improved in June and the unemployment rate in Spain dropped below 25% for the first time in almost two years. However, German business confidence dropped and triggered worries. In the US, worries came from weak sales of new homes, but the drop of jobless claims to an 8 year low had the upper hand and certainly supported the greenback.

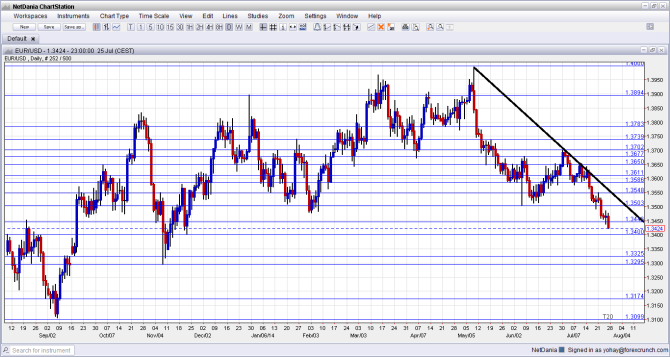

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- German CPI: Wednesday. Germany’s inflation rate advanced faster than expected in June, rising 0.3% on a monthly base and 1.0% on a yearly base according to a preliminary estimate. The Monthly reading was higher than the 0.2% rise predicted by analysts. However, the readings showed a mixed picture of consumer prices. Inflation rate is expected to rise 0.2%.

- Spanish CPI: Wednesday. Annual inflation rate in Spain inched 0.1% in June, according to preliminary estimates. The data was lower than the 0.3% gain expected by analysts and the 0.2% registered in the prior month. The National Institute of Statistics (INE) said that the difference between May’s and June’s annual inflation rate was due to variations in prices of food, non-alcoholic drinks and electricity. Spanish inflation is expected to gain 0.2% this time.

- Spanish Flash GDP: Wednesday, 7:00. Spanish economy expanded 0.4% in the first quarter. The increase was in line with the Bank of Spain’s estimate, followed the 0.2% expansion registered in the fourth quarter of 2013. The first quarter gain marked the largest expansion since Q1 2008. On an annual base, GDP increased 0.6% in the first quarter. The Central Bank forecasted a growth rate of 1.2% in 2014 and a higher reading of 1.7% expansion in 2015. Spanish economy is predicted to grow 0.5%.

- German Retail Sales: Thursday, 6:00. German retail sales declined unexpectedly in May, down 0.6% following a 1.5% fall in April. Analysts expected sales to rise 0.8%. However, on a yearly base, sales advanced 1.9% in May, rising 1.4% in the first five months, indicating consumer sentiment is improving. German retail sales are expected to rise 1.1%.

- French Consumer Spending: Thursday, 6:45. French consumer spending strengthened in May, rising 1.0% after contracting a 0.2% in the previous month. Energy was the biggest contributor to consumer spending advancing 8%. In the first quarter of the year, spending declined 0.5% and economic growth ground to a halt. French consumer spending is expected to rose 0.3%.

- German Unemployment Change: Thursday, 7:55. German unemployment edged up unexpectedly in June, rising by 9,000 to 2.916 million, while economists expected a drop of 9,000. The weaker hiring in spring was due to smaller job cuts in the early months of the year. The number of jobless claims are expected to decline by 5,000.

- CPI Flash Estimate: Thursday, 9:00. Euro zone inflation remained sluggish in June, rising 0.5%, similar to the prior month, while economists forecast a stronger rise of 0.6%. Meanwhile Core CPIexcluding food, energy, alcohol, and tobacco increased 0.8%, mildly better than the 0.7% rise predicted. However the overall readings remaine weak despite the measures taken by the ECB to spur inflation and economic activity by cutting interest rates and imposing negative interest rateand cheap long-term loans to banks to increase bank loans. However the impact of the ECB steps will take longer to measure. Euro zone inflation is expected to remain 0.5%.

- Unemployment Rate: Thursday, 9:00. Eurozone Unemployment rate remains elevated in May, despite a small improvement from the previous month, reaching 11.6%. Job creation is weak especially on Spain and Greece where unemployment is above 25% while in Germany the unemployment level is low reaching 5.1%. The euro area economy expanded for the fourth consecutive quarter at the beginning of the year but struggles to shift its rebound into a higher gear. Eurozone Unemployment rate is predicted to remain unchanged at 1.6%.

- Spanish Manufacturing PMI: Friday, 7:15. Spanish manufacturing sector expanded better than expected in June rising to 54.6 from 52.9 in May. The rise was higher than the 53.2 reading predicted by analysts, but confirms forecasts that the Spanish economy will continue to improve in the coming months. The new orders section increased to 56.3 from 53.4 implying the index is now at the highest level since April 2007. Exports orders increased to 56.7 in June from 53.3 in May and the employment index increased to 53.0, which is the highest level since July 2007. A further rise to 54.8 is forecasted.

- Italian Manufacturing PMI: Friday, 7:45. Italian manufacturing PMI inched down from 53.20 in May to 52.60 in June, falling below expectations for 53.5 reading. Even though manufacturing activity remained in expansion territory, growth slowed for the second straight month, indicating a fragile recovery. Italian manufacturing PMI is expected to reach 52.8.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with an attempt to recapture the 1.3550 line (mentioned last week). After this move failed, it was all downhill: the pair managed to hold 1.3450 for a short while before surrendering this level as well and closing at 1.3424.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

We start from lower ground this time. The round number of 1.37, is another support line after capping the pair in December yet it is weakening. 1.3677 was the peak in June so far, and could turn into important resistance.

1.3650 worked as strong resistance during May and June but is weakening now. 1.3585 served as the bottom of the range and still carries weight despite the breakdown in June. 1.3550 worked as support in January but is now weakening.

The round number of 1.35 worked as the last cushion in June and is strong also due to the roundness. 1.3450 worked as resistance in August 2013 and as support in September and October. It is now a key line on the upside.

The round number of 1.34 was last seen in December as a stepping stone for the pair on its way down. Below, the next line of support is only at 1.3325, a level that separated ranges back in September 2013.

1.3295 is the next line: it was the low level in November. Below this line the round number of 1.32 is the important due to its role in August 2013.

Downtrend resistance

As the thick black line on the chart shows, the pair is trading under downtrend resistance since it peaked near 1.40 in early May. The line is respected on the daily chart. The pair drifted further away from the line.

I am bearish on EUR/USD

With inflation numbers coming out of the euro-zone, we will probably get a stark reminder of why the ECB is in an ultra-easing policy, and that’s here to stay, especially as German business confidence slides and France is still lagging behind. In the US, even a miss on GDP and the NFP are not set to divert the Fed from its gradual path to tightening. Recent data is quite encouraging. The “buy the dips” mode that characterized the pair’s trading for a long time seems to have vanished: bad news sticks.

More EUR/USD:

- Fed cannot stop the stock market; ECB would feel relaxed with EUR/USD at 1.20

- German Weltschmerz Hammers Markets

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.