EUR/USD had another busy week, with Greece playing an increasing role in shaping the direction. An important German survey and inflation numbers stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

German industrial output beat expectations and was one of the reasons for the positive start for the pair, together with rising German yields. However, then Greece took over. Optimism about a German compromise on a deal helped only temporarily, and things worsened quite quickly, with yet another deadlock. Greece seems to have leverage. The euro was also hit by German Chancellor Merkel, that indirectly complained about the currency’s strength. The pair was indeed capped at a double top. In the US, data was generally upbeat, but traders were hesitant to buy the greenback ahead of the Fed.

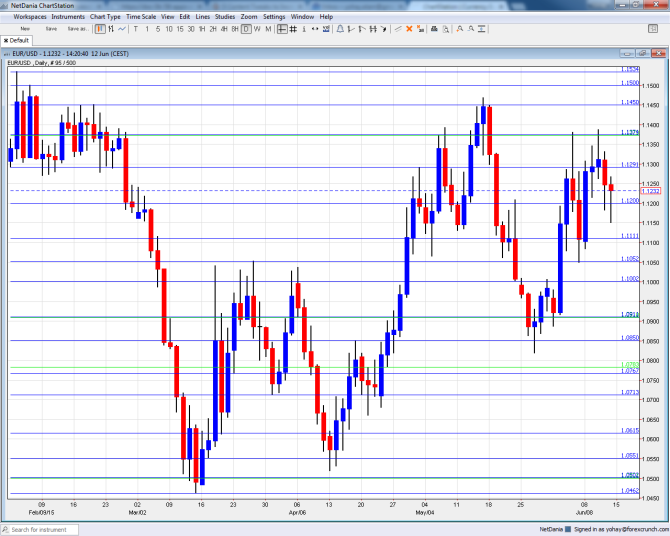

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Jens Weidmann talks: Monday, 7:00. The president of the German Bundesbank speaks in Frankfurt and it will be interesting to hear his comments on various fronts: on the state of the German economy, on Merkel’s backing of the ECB’s QE program, which Weidmann doesn’t really like and on Greece of course.

- Trade Balance: Monday, 9:00. The euro-zone enjoys a surplus in its balance, mostly thanks to German exports. After a positive number of 19.7 billion back in March, a slightly stronger figure is on the cards for April: 20.3 billion.

- Mario Draghi testifies: Monday, 13:00. The president of the ECB goes to Brussels to testify on monetary policy. The long time between now and the next decision means that Draghi could feel free to talk about the ECB’s plans, front loading QE, volatility in the markets and the ECB’s growing commitments to Greece. A repeat of his determination to push forward with QE despite improving conditions could weigh on the euro. However, in his last major appearance he was relaxed on volatility, and basically allowed the euro to rally.

- German Final CPI: Tuesday, 6:00. The initial read for May showed a rise of 0.1% in prices m/m. This contributed to the overall beat in euro-zone data. The number will likely be confirmed now.

- German ZEW Economic Sentiment: Tuesday, 9:00. This early survey dropped for the second month in a row in May, and with a bigger than expected fall to 41.9 points. The positive sign before the number still indicates optimism, but it is off he highs. A small drop to 38.6 points is on the cards for June. The all-European number could slide from 61.2 points seen in May to 60.3 now.

- Euro-zone Employment Change: Tuesday, 9:00. While a lagging figure, the employment change release provides a wide look at trends. An advance of 0.1% was seen in Q4 2014 and a repeat could be recorded for Q1.

- Final CPI: Wednesday, 9:00. The initial inflation figures came out better than expected: 0.3% in headline inflation and +0.9% in core inflation, the latter being more surprising. The figures helped the euro and also raised some speculation about an early end to QE, something that was repeatedly rejected. A confirmation of the data is expected, but revisions are quite common.

- Eurogroup and ECOFIN meetings on Greece: Thursday and Friday. These are scheduled meetings of the euro-zone finance ministers and then a meeting of all 28 EU members. Thursday’s meeting is currently seen as the “last deadline” in order to approve a deal for Greece. The current program expires on June 30th, which is also the date that the debt stricken country has to pay its “bundled” IMF loans. And, it doesn’t have the money to do so. While negotiations are going on all the time, including on weekends, the official meeting on Thursday is a climax, and it could be dragged into Friday as well. More: Why Greece currently has leverage over all troika members

- ECB Economic Bulletin: Thursday, 8:00. This report by the central bank is what the Governing Council members saw before making their decision in June – a decision that was characterized by the lack of worries about higher bond volatility. An insight into these figures usually repeats what we have already heard from Draghi, but could also contain some interesting observations about the economy.

- TLTRO: Thursday, 9:15. TLTRO means targeted loans: cheap money the ECB lends to commercial banks on the condition they lend the money to the real economy. The first auction in September resulted in €82.6 billion, the second one in December yielded €129.8 billion and the last one came out at €97.8 billion in March. A high value of loans means more liquidity and a lower need to buy bonds. It also means more economic activity. The determination of the ECB to keep on buying bonds makes the publication somewhat less important than it used to be, but it should still shake the common currency a bit.

- German PPI: Friday, 6:00. Producer prices advanced 0.1% in March, and a slightly stronger number is on the cards for April: +0.2%. Similar to the WPI, also the PPI feeds into future inflation numbers.

- Current Account: Friday, 8:00. As with the trade balance indicator, the wider current account figure, which also consists of other flows, is positive. However, the last two releases were somewhat disappointing. After 18.6 billion in March, a similar figure of 18.6 billion is predicted for April.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week on an upward note and eventually made it to the 1.1373 level (mentioned last week). It then reversed and fell to 1.1150 before bouncing again.

Live chart of EUR/USD: [do action=”tradingviews” pair=”EURUSD” interval=”60″/]

Technical lines from top to bottom:

The round level of 1.15 has a psychological impact and it also worked as support in the past. 1.1450 capped the pair during February’s recovery attempts and also during May.

Below, the historic line of 1.1373 (from November 2003) still has a role as resistance. 1.1290, which was a peak in April and support in February is significant resistance.

1.1190, just below the round number of 1.12, proved its strength as a double top in June 2015. It is followed by a low seen in January of 1.1113 which is nearly 0.90 on USD/EUR.

1.1050 was a high point in March 2015 and now works as important support before the round level of 1.10. This is still a battle line.

The next line was minor support back in October 1999: 1.0910. It was resistance back then and was tested once again in March 2015. This is followed by 1.0815 which worked in both directions.

The next line is 1.0760, which was the low point in both July and August 2003. 1.0715 joins the chart after temporarily capping the pair in April 2015.

1.0660 worked nicely as support in April 2015. 1.0615, which worked in both directions during March 2015 and is better at support.

Another minor line is 1.0550, for a role as support in the same period of time. The very round level of 1.05 served as support during 2003. The lowest level in over 12 years is 1.0462 and this makes it critical support.

Below this point we have the very obvious level of 1 – EUR/USD parity, which is already eyed by more and more analysts

I remain bearish on EUR/USD

Even if the Greek crisis is somehow resolved this week (and it could still be delayed until the very last moment), monetary policy divergence still plays a key role. With German Chancellor Merkel putting her weight behind the ECB and against EUR strength and another reminder from Draghi on that coming up now, pressure could continue on the common currency. On the other side of the Atlantic, all eyes are on the Fed, which could certainly provide support for the greenback.

In our latest podcast, we bring you up to speed with the Fed decision and the USD impact, and also tackle the Greek crisis from two different angles.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.